The US dollar took a hit on the weak durable goods orders numbers, and could not recover on strong numbers from new home sales and consumer confidence.

However, the team at Morgan Stanley sees the super cycle of the strengthening dollar intact, and suggests selling rebounds on EUR/USD:

Here is their view, courtesy of eFXnews:

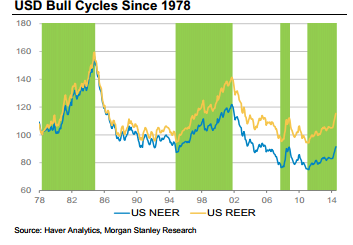

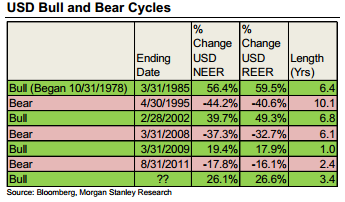

Past USD super cycles on average saw durations of almost seven years and TWI increases of nearly 48%, notes Morgan Stanley.

USD Super Cycle:

“We believe that we are currently in the middle of the third major USD bull market of the past forty years. An extraordinarily long projected US economic expansion, widening growth differential between the US & the rest of the world, and increasing flow of investment back towards the States suggests that the USD rally will extend further,” MS argues.

How Much Further Can We Go?

“We now see the USD strengthening across the board by roughly 6% each year across our forecast horizon (end 2016). A repeat of the USD performance seen in the 1990s looks increasingly likely,” MS projects.

Bearish EUR: Powerful QE:

“The ECB’s decision to expand its asset-purchase program keeps us bearish on the EUR. With the long-awaited sovereign QE announcement finally coming through and political risks not going away, EUR/USD could well approach parity,” MS projects.

…But Not Just QE.

“However, our bearish EUR view is not just about QE. We have made the case that the EUR is set to weaken as a result of previously announced monetary policy measures from the ECB, which have already had an impact. We have highlighted three main channels for EUR weakness: portfolio outflows, the use of the EUR as a funding currency and central bank reserve reallocation. There is evidence that all three channels have already been exerting downward pressure on the EUR,” MS clarifies.

“Meanwhile, the latest data from the IMF shows that central banks, especially in EM, have been significant net sellers of EUR, reducing the weighting of EURs in their FX reserves. These represent a significant structural outflow from EMU, likely keeping the EUR under significant pressure over the longer term. The addition of QE from the ECB will exacerbate these outflows, we believe, reinforcing the EUR bearish trend, hence our below consensus forecast for EUR/USD,” MS adds.

The Trade:

MS maintains a limit order in its strategic portfolio to sell EUR/USD at 1.15, with a stop at 1.1650, and a target at 1.0900.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.