The British Services PMI (Purchasing Managers’ Index) is based on a survey of purchasing managers in the services sector. Respondents are surveyed for their view of manufacturing conditions in the UK. A reading which is higher than the market forecast is bullish for the pound. Update: UK Services PMI falls to 55.8 – new low for GBP/USD Here are all the details, … “GBP/USD Trading the UK Services PMI January 2015”

Month: January 2015

Gold looks ready to go higher from here – Technical

The big picture in Gold hasn’t changed much over the past month. For approximately nine weeks now Gold has been consolidating around prior support of 1,182.20, a price first hit back in June of 2013. This price area was then tested as support first in December 2013, then more recently in May 2014. During that … “Gold looks ready to go higher from here – Technical”

Forex: 2015 will be year of US interest rate rise

The scene looks set for the US Federal Reserve to start raising interest rates in 2015 – a shift in the monetary cycle, which could unleash more turmoil in currency and other markets, such as equities. It will also highlight increasing divergence between the US and the Eurozone and Japan. The US economy is in … “Forex: 2015 will be year of US interest rate rise”

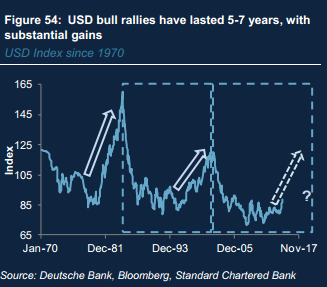

Despite Its Sharp Rally, The USD Is Still Cheap –

Yes, the dollar ran higher and higher, but it probably is not enough. And it is not only a euro story, or weaker China hitting the Australian dollar, oil hitting the loonie and elections weighing on the pound. If this is a historic dollar cycle, there is so much room to run. The team at Standard … “Despite Its Sharp Rally, The USD Is Still Cheap –”

Dollar Enters New Year on Strong Footing

This trading week was relatively calm due to the holiday season as fewer traders were participating in the market and volume was light. Yet this did not prevent the dollar from reaching new highs against its major peers. The greenback was gaining on its counterparts for the most part of the week. While there were moments when it looked like the dollar may lose its upward momentum, the US currency … “Dollar Enters New Year on Strong Footing”

Malaysian Ringgit Dragged Down by Oil Prices & Strong Dollar

The Malaysian ringgit dropped against the US dollar today as a drop of crude oil prices should reduce trading revenue of Malaysia — a net oil exporter. Additionally, the greenback was strong on its own right. While crude oil attempted to reverse its decline, the commodity was unable to keep its upward momentum. Signs of oversupply on the energy market did not allow prices to keep bullish tendencies. The ringgit dropped because of this … “Malaysian Ringgit Dragged Down by Oil Prices & Strong Dollar”

Pound Drops to Lowest Since August 2013 vs. Dollar

The Great Britain pound sank today, reaching the lowest level since August 2013 against the US dollar, as UK manufacturing slowed unexpectedly by the end of the year. The data suggested that the nation’s central bank will not be in a hurry to start raising interest rates. The seasonally adjusted Markit/CIPS manufacturing Purchasing Managers’ Index dropped from 53.3 in October to 52.5 in December. Market participants counted on an increase to 53.7. The report added to speculations … “Pound Drops to Lowest Since August 2013 vs. Dollar”

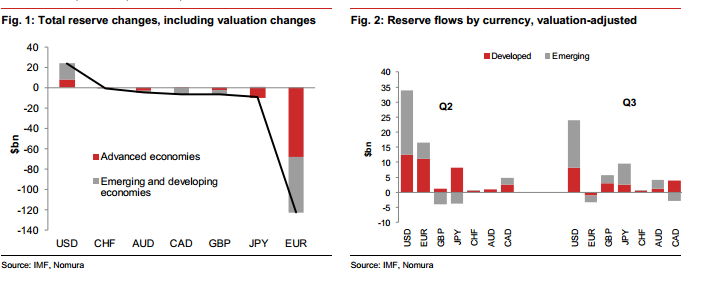

This Could Be A ‘Big Deal’ For Faster EUR Decline

EUR/USD began 2015 with a storm and already reached the lowest levels since 2010. Comments by Draghi are one reason, but not the only one. The tam at Nomura provides a much bigger issue for the single currency: Here is their view, courtesy of eFXnews: Every quarter the IMF puts out a snapshot of global central … “This Could Be A ‘Big Deal’ For Faster EUR Decline”