The moment of truth is approaching for the Reserve Bank of Australia. After two months, the central bank convenes again.

Will Stevens cut the interest rate? Where is AUD/USD headed to?

Here is their view, courtesy of eFXnews:

The AUD has been another currency succumbing to a resurgent USD over the last six months, depreciating by almost 16%, notes CIBC World Markets.

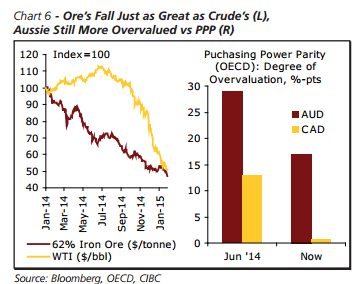

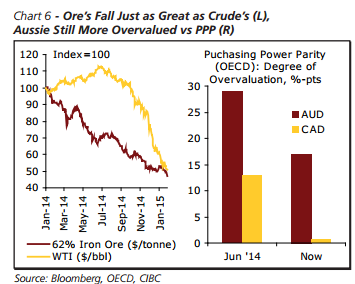

“And although in Canada we’re familiar with the effect that crude’s drop has had on the loonie, iron ore has seen a more persistent—if slightly less dramatic—decline since the beginning of 2014. It’s no doubt that the drop in Australia’s most important commodity export is a key driver of the AUD’s recent trajectory, but rates should also play a role in the AUD’s performance this year,” CIBC argues.

“While the RBA continues to maintain that they’re standing pat on policy—fearing what are already elevated debt levels and housing market froth— implied rate expectations have been sliding since mid-September. That said, easing would likely have to be preceded by macro-prudential measures to stem accelerating housing market activity that is seen as a stability risk,” CIBC adds.

“As for the AUD, the currency remains well in overvalued territory, at more than 15% above the long term OECD ‘fair value’ estimates. And while we don’t expect it to close the gap with that measure entirely, look for AUDUSD to breach 0.75—a level recently mentioned by RBA Governor Stevens—,” CIBC projects.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.