Cable continues battling the 1.50 line amid speculation about the timing of the next move by the Bank of England.

Mark Carney and co. are meeting soon, but no change is expected anytime soon. The team at Morgan Stanley stays short and revises the target down to 1.38:

Here is their view, courtesy of eFXnews:

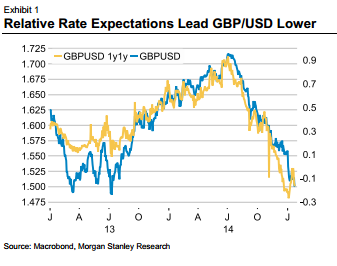

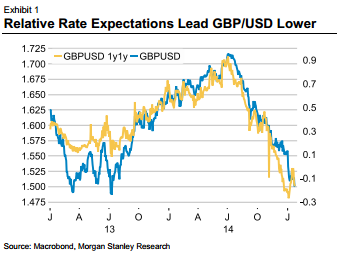

Morgan Stanley’s bearish GBP/USD view is not just a function of a strong USD, as MS believes that outright GBP weakness is set to be a driving factor.

“Moderating UK growth, the BoE returning to a more dovish stance as the two hawks on the MPC withdraw their vote for a hike, and increased political uncertainty are likely to deter foreign investment inflows, which have been an important supportive factor for GBP over the past couple of years,” MS argues.

“The UK is faced with fiscal tightening and political policies which appear unattractive to foreign investors regardless of who wins the general election in May. As a result, we have taken our already-bearish GBP/USD forecasts even lower,” MS adds.

“Indeed, GBP/USD has already accelerated the major downtrend, breaching the 1.50 level, opening the way for an initial decline towards the lows of 2013 at 1.4815. Once below here, the medium-term bearish outlook will be extended, we believe,” MS projects.

Below-Consensus GBP:

As a result, MS has taken our GBP/USD forecasts sharply lower, expecting 1.38 by end-2015, significantly below market consensus projections

The trade:

In line with this view, MS maintains a short GBP/USD in its strategic portfolio from 1.52, with a revised stop at 1.5280, and a target at 1.40.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.