The US dollar moved a bit lower against the Japanese yen recently, as the later one got bid across the board. There were some low risk events lined up in Japan today including the Securities investment, released by Ministry of Finance. The outcome was better than the market’s expectation, as it climbed to ¥675.2B from ¥44.2B. The last reading was revised down from the ¥45.6B to ¥44.2B. The Japanese yen gained traction, but the USDJPY pair has a major support formed around the 117.20-00 area, which held losses in the pair in the near term. Let us see how it trades in the NY session, especially after the releases in the US.

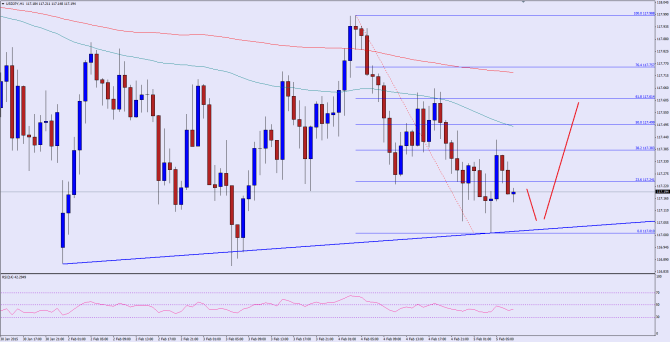

There is a monster bullish trend line formed on the hourly chart of the USDJPY pair, which is acting as a hurdle in the short term. The US dollar buyers have struggled time and again to clear the mentioned level which is currently around 117.05. However, there are a couple of negative things to note, including the fact that the pair is well below the 100 and 200 hour moving averages. Moreover, the hourly RSI has moved below the 50 level, which might encourage the Japanese yen buyers in the near term. A break below the highlighted trend line and support area could ignite sharp losses in USDJPY moving ahead.

On the upside, initial resistance is around the 117.40 level, followed by the most important one -100 hour MA where sellers might appear again.

Overall, one might consider buying dips in the USDJPY pair as long as it is trading above the stated trend line.

————————————-

Posted By Simon Ji of IKOFX