Quantitative Easing has already been announced in the euro-zone and will come into effect in March. This is set to have a wide impact on all markets.

Tom Fitzpatrick at CitiFX sees the euro weakening all the way to parity with the USD and explains:

Here is their view, courtesy of eFXnews:

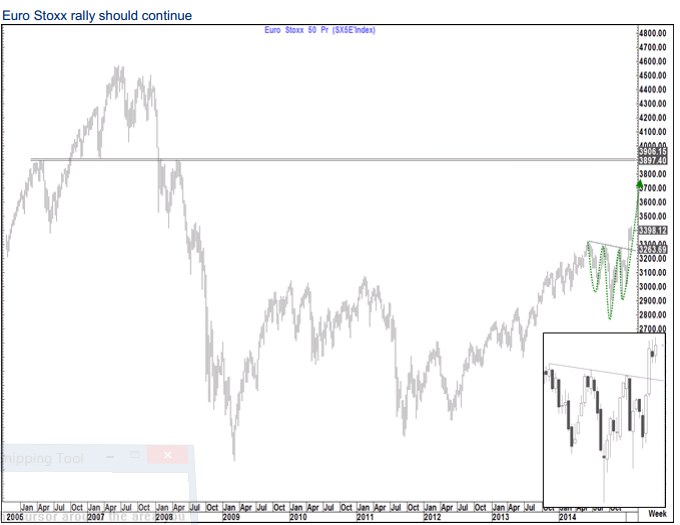

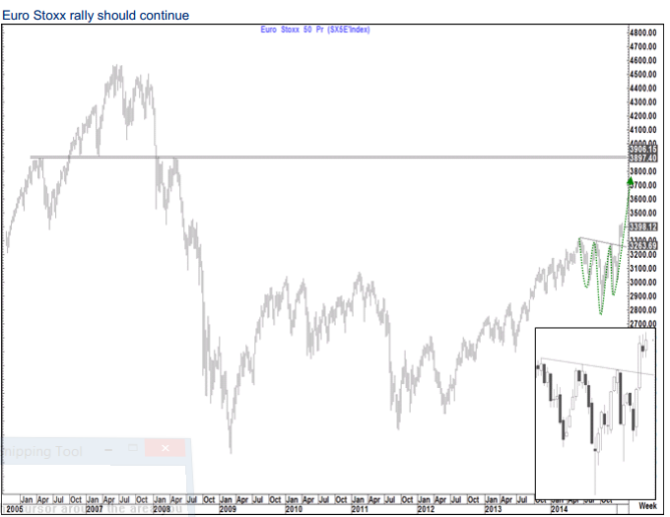

“A number of European Equity markets look quite constructive at this point. This is consistent with the “post QE” world of the last 6 years or so. A weaker EURO is likely to be supportive of this (As we saw in Japan with the JPY) suggesting that these holdings should be hedged from a foreign investment (USD) perspective.

We remain of the big picture view that EURUSD will continue to push down and head towards parity, if not lower, by year-end.

European Equity Indices as a whole saw important breaks in January which indicate even higher levels are likely in the coming months given…

-The positive effect seen in equity assets of countries that engage in quantitative easing.

-A significant portion of earnings come from abroad, making a weaker EURO beneficial to some corporate bottom lines.”

Tom Fitzpatrick – CitiFX

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.