The implementation of the ECB’s massive QE program is just around the corner. How will it impact the exchange rate? And what happens if the balance sheet does not rise as expected?

The team at Morgan Stanley provides some answers:

Here is their view, courtesy of eFXnews:

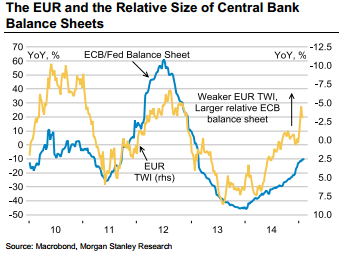

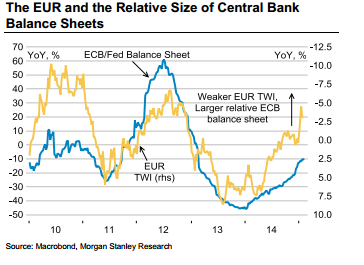

“Rate and yield differentials working against the EUR still stay in place, in our opinion. The increase of euro-system central bank balance sheets may reduce the yield for safe assets and free liquidity for other riskier asset classes inside and outside EMU.

A technical failure to increase balance sheets, related to lack of bond supply, would force core EMU bond yields even lower when compared to a situation where bond supply were adequate for euro central banks to conduct their monetary easing operations as planned. Accordingly, central banks falling short of expanding their balance sheets as planned should have little impact on the performance of the EUR.

The impact on the EUR would be positive only in the case of EMU’s nominal GDP expanding at a rapid pace, making the ECB re-think its expansionary strategy. In this case, EUR yield differentials would turn supportive due to increasing capital demand in the eurozone.

A technical reason for the ECB falling short in its plans to deliver a balance sheet expansion should have very little impact on the EUR. We will be watching the ECB purchasing program as it starts in March, but overall we remain EUR bears, forecasting 1.05 for year end.”

Hans Redeker, Sheena Shah – Morgan Stanley

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.