The euro is looking to recover on some positive news regarding Greece. However, this happiness may not last too long, says the team at RBS.

Here is their rationale:

Here is their view, courtesy of eFXnews:

“Traders may have been reluctant to chase traditional growth currencies since they can see rate rises coming in the US and are reluctant to sell dollars. They are also reluctant to sell EUR and JPY further after they have traded to multi-year lows. Meanwhile the EUR has reverted to trading on Greek debt crisis news, even though this is of questionable relevance for the currency.

The price action in EUR remains generally bearish, perhaps more so this week. It has quickly moved back to the lower end of its recent relatively tight range despite news that suggests that Greece will be given more time to come to a new agreement with its EUpartner creditors.

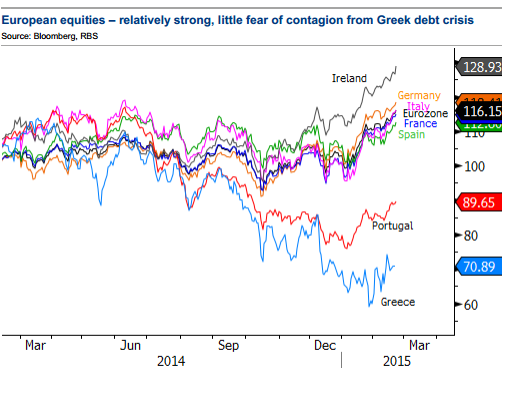

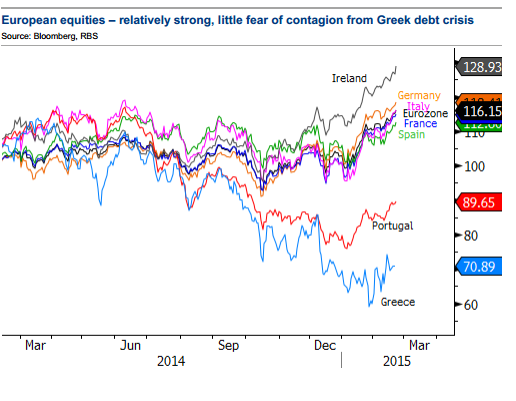

Greek-debt fears have hardly hurt other European assets. Equities in the region are hitting new highs, and have even recovered from recent lows in Greece. And non-core periphery bond spreads (excluding Greece) have narrowed to new lows. This suggests that the power of positive sentiment surrounding the Greek debt crisis to support EUR is waning.”

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.