The Australian dollar continued to rally against the Japanese yen today following yesterday’s gains but fell against other major currencies including the US dollar. News from Australia itself was good but reports from China were disappointing. Australian business confidence improved a little in January, and the House Price Index grew in the last quarter of 2014. Meanwhile, China’s consumer inflation slowed much more than was anticipated … “Aussie Extends Rally vs. Yen, Drops vs. Greenback”

Month: February 2015

US Dollar Index Heads Higher as Greek Drama Continues

US dollar index is heading higher against today, helped along by Greek drama as the euro struggles. There doesn’t seem to be a good solution to the Greek problem right now, and there are now calls for Greece to abandon the euro — and perhaps use the dollar. Greenback is trading mixed today against its major counterparts, but the dollar index is higher, thanks in large part to the fact that the euro is … “US Dollar Index Heads Higher as Greek Drama Continues”

Swiss Franc Drops in Forex Trading

Swiss franc is lower today, even though it has been showing some strength recently. Franc is even lower against the euro today, and the euro is struggling in general. Swiss franc is heading lower as deflationary pressures set in, thanks to the recent move by the Swiss National Bank to unpeg the franc from the performance of the euro. Last month, the SNB got rid of the peg, and it’s been an interesting ride … “Swiss Franc Drops in Forex Trading”

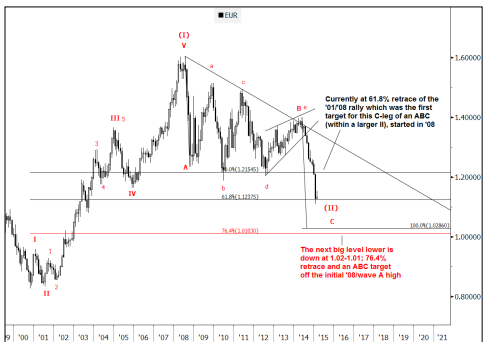

EUR/USD: A-B-C Pattern; The Next Big Level – Goldman

EUR/USD is somewhat stuck in narrower ranges, especially when comparing to recent volatility. What’s next for the pair? The team at Goldman Sachs examines the charts from an Elliott Wave Perspective: Here is their view, courtesy of eFXnews: EUR/USD price-action from the Jan. 26th low looks like a complete ABC pattern which is characteristically corrective, … “EUR/USD: A-B-C Pattern; The Next Big Level – Goldman”

10 brokers still going after negative balances

While we are almost a month away from the SNBomb, the aftershocks are still felt. The sudden leap in the Swiss franc’s value left quite a few clients that shorted CHF in a case of a negative equity. Most forex brokers did forgive negative balances: accepted the liquidation of the clients’ accounts and didn’t demand them … “10 brokers still going after negative balances”

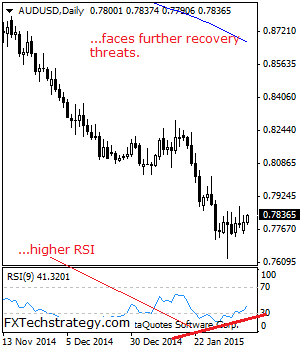

AUDUSD: Develops Recovery Threats

AUDUSD continues to trace out a bottom as a platform for its impending correction. On the downside, support resides at the 0.7750 level where a breach will aim at the 0.7700 level. Below that level will set the stage for a run at the 0.7650 level with a cut through targeting further downside towards the … “AUDUSD: Develops Recovery Threats”

GBP/USD Weak And Vulnerable

GBPUSD: With GBP now seen following through on the back of its Friday weakness, further decline is envisaged. This development leaves it targeting further downside but with caution. On the downside, support lies at the 1.5150 level where a break if seen will aim at the 1.5100 level. A break of here will turn attention … “GBP/USD Weak And Vulnerable”

Yuan Weakens After Chinese Trade Data

The Chinese yuan fell today even as data released over the weekend showed that the nation’s trade balance improved. The caveat is that the improvement was a result of the sharp drop of imports, not due to growth of exports (which actually also fell, just not as much as imports). The Customs General Administration of China reported that China’s trade surplus expanded from $49.6 billion to $60.0 billion in January even though most … “Yuan Weakens After Chinese Trade Data”

Australian Dollar Rises on Jobs Data

The Australian dollar rose today due to signs of continuous improvement of Australia’ labor market. The number of jobs advertisements grew for the eighth consecutive month in January, suggesting that the Australian economy performs relatively well. The ANZ jobs advertisements rose 1.3 percent last month after increasing 1.8 percent in the month before. ANZ Chief Economist Warren Hogan said: The eighth consecutive monthly rise in ANZ job ads is an encouraging … “Australian Dollar Rises on Jobs Data”

Euro Struggles to Move Higher Against Other Majors

Euro is struggling to move higher against other majors today following drops precipitated by more drama out of Greece. There is a great deal of uncertainty surrounding the euro right now, and that is weighing on the 19-nation currency. Even though the euro has eked out some gains, trading has been volatile and the gains may not last. Former Fed Chair Alan Greenspan is predicting that Greece … “Euro Struggles to Move Higher Against Other Majors”