British Manufacturing Production, a key indicator, provides analysts and traders with a snapshot of the health of the UK manufacturing sector. A reading which is higher than the market forecast is bullish for the pound. Update: UK manufacturing output beats expectations Here are all the details, and 5 possible outcomes for GBP/USD. Published on Tuesday at … “GBP/USD: Trading the British Manufacturing Feb 2015”

Month: February 2015

SNBomb – Reactions from 75 forex brokers

The shock move from the Swiss National Bank has significantly impacted foreign exchange and also foreign exchange brokers. We already noted how such events are tests for brokers. And now, here is a round up reactions (updated) This is only a partial list giving you an idea of the range of responses: from making profits / business as … “SNBomb – Reactions from 75 forex brokers”

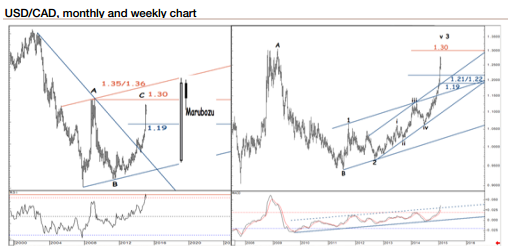

USD/CAD: Still En-Route To 1.30; AUD/USD: H&S Confirmed –

Both AUD and CAD managed to overcome recent blows and stage recoveries. Is this sustainable? Not so fast. The team at SocGen sees both commodity currencies weakening, and sets targets: Here is their view, courtesy of eFXnews: USD/CAD in resuming its move higher and still en-route to test March 2009 highs of 1.30, notes SocGen. “Monthly RSI is … “USD/CAD: Still En-Route To 1.30; AUD/USD: H&S Confirmed –”

Forex Best Awards 2015 released

The FXStreet Forex Best Awards for 2015 were released. The winners, from 9 different categories, also appear in a video below. They were chosen from around 40 nominees by both popular vote and a jury of experts. I had the honor to participate in the professional jury and am certainly happy with the results. Here are more … “Forex Best Awards 2015 released”

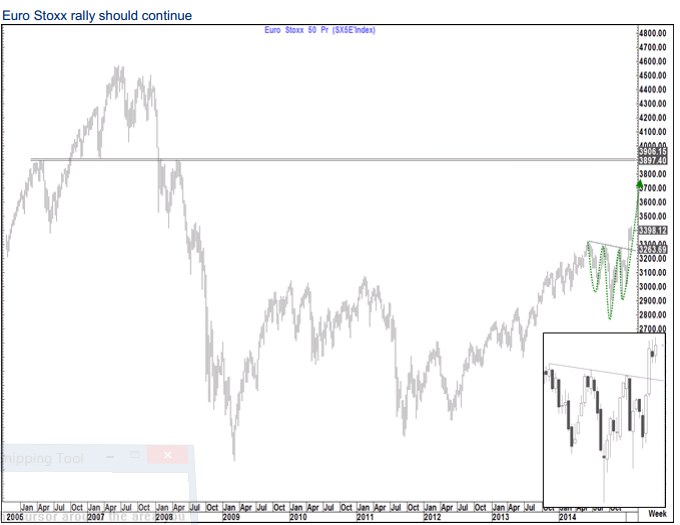

EUR/USD En-Route To Parity As European Equity Markets Set

Quantitative Easing has already been announced in the euro-zone and will come into effect in March. This is set to have a wide impact on all markets. Tom Fitzpatrick at CitiFX sees the euro weakening all the way to parity with the USD and explains: Here is their view, courtesy of eFXnews: “A number of European … “EUR/USD En-Route To Parity As European Equity Markets Set”

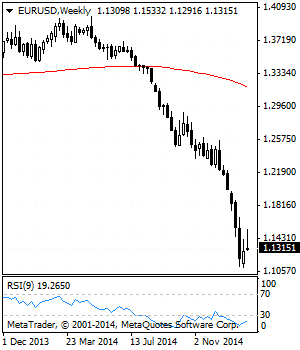

EUR/USD Faces Downside Pressure

EURUSD: With EUR closing marginally lower on a price rejection candle formation, further downside pressure is envisaged. Support is seen at 1.1250 level with a cut through here opening the door for more downside towards the 1.1200 level. Further down, support lies at the 1.1150 level where a break will expose the 1.1110 level. Its … “EUR/USD Faces Downside Pressure”

Mixed Week for US Dollar

The US dollar was rather mixed during this week. The currency fell against the euro initially but bounced later to end the week flat. The greenback climbed against the euro but dropped versus commodity currencies as well as the Great Britain pound. While non-farm payrolls were a major supporting factor for the US currency, they came out at the end of the week and were not able to allow the greenback rise much higher. It … “Mixed Week for US Dollar”

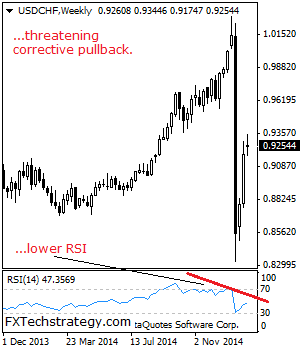

USDCHF: Closes Flat, Faces Corrective Pullback Risk

USDCHF: With a flat price action trading occurring the past week, risk of an impending corrective pullback continues to loom. On the downside, support lies at the 0.9200 level with a break targeting the 0.9150 level and then the 0.9100 level. Further down, support comes in at the 0.9050 level. On the upside, resistance resides … “USDCHF: Closes Flat, Faces Corrective Pullback Risk”

Excellent Employment Report Makes Canadian Dollar Stronger

The Canadian dollar gained today with the help of the excellent employment report. While the loonie was unable to beat the US dollar, the currency demonstrated big gains against its other major peers. Statistics Canada reported that Canadian employment grew by 35,400 jobs in January. It is a much bigger increase than gain of 4,700 predicted by analysts. As additional positive news, the unemployment rate slipped by 0.1 percentage point to 6.6 … “Excellent Employment Report Makes Canadian Dollar Stronger”

Dollars Shoots to Upside After Stellar Non-Farm Payrolls

The US dollar soared today after US non-farm payrolls demonstrated amazing figures even though the unemployment rate increased. The greenback was especially strong against the Japanese yen. Non-farm payrolls showed that US employers added as much as 257,000 jobs in January, beating analysts’ expectations. On top of that, the December growth received a massive positive revision from 252,000 to 329,000. What is more, wages were growing faster … “Dollars Shoots to Upside After Stellar Non-Farm Payrolls”