The NFP is eyed with worries after recent US data. And what about wages? The RBA cut rates: a one off or just the beginning? The ECB’s late night move against Greece only temporarily hurt the euro. How will this evolve? And oil is finally recovering, but is this only a correction? Welcome to a new … “NFP Preview, Aussie Analysis, Greek Grindings and Oil Optimism”

Month: February 2015

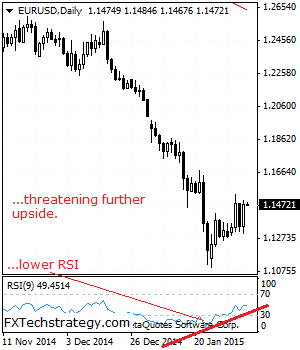

EUR/USD Builds Up Upside Momentum

EURUSD: With EUR reversing its Wednesday losses on Thursday, further upside pressure is envisaged. Support is seen at 1.1400 level with a cut through here opening the door for more downside towards the 1.1350 level. Further down, support lies at the 1.1300 level where a break will expose the 1.1250 level. Its daily RSI has … “EUR/USD Builds Up Upside Momentum”

Dollar Broadly Lower After Mixed US Data

Today, the US dollar traded broadly lower against most of its major counterparts, with the exclusion of the Japanese yen, after mixed macroeconomic indicators from the United States and news from Europe. US initial unemployment claims rose by 11,000 to 278,000 last week. Yet the report was not considered completely bad as analysts have expected an even bigger increase. The trade balance was the really disappointing indicator as it showed … “Dollar Broadly Lower After Mixed US Data”

Swiss Franc Trades in Tight Range

As the majority of currencies, the Swiss franc rose against the US dollar and the Japanese yen but fell versus the euro during the current trading session. It was rather surprising behavior, considering that news from Europe was not good. The Swiss franc declined in the weeks following the huge jump after the Swiss National Bank decided to scrap the cap on the currency. Recently, the Swissie was trading sideways in a tight range. It may … “Swiss Franc Trades in Tight Range”

EUR/USD: Trading the US NFP Feb 2016

US Nonfarm Employment Change measures the change in the number of newly employed people in the US, excluding workers in the farming industry. A reading which is higher than the market forecast is bullish for the dollar. Here are the details and 5 possible outcomes for EUR/USD. Update: Non-Farm Payrolls +257K – above expectations – USD … “EUR/USD: Trading the US NFP Feb 2016”

AUDUSD: Faces Recovery Risk

AUDUSD: With AUDUSD threatening further corrective recovery, bull pressure is envisaged. On the downside, support resides at the 0.7750 level where a breach will aim at the 0.7700 level. Below that level will set the stage for a run at the 0.7650 level with a cut through targeting further downside towards the 0.7600 level. On … “AUDUSD: Faces Recovery Risk”

Australian Dollar Resilient in Face of Negative Fundamentals

The Australian dollar edged higher today even though fundamentals, both domestic and overseas, were not particularly supportive for the currency. The currency has been surprisingly resilient after the unexpected interest rate cut from the Australian central bank. Today’s data from Australia was disappointing as it showed growth of retail sales at 0.2 percent in December, below analysts’ projections. Coupled with the recent surprise interest rate cut from … “Australian Dollar Resilient in Face of Negative Fundamentals”

Pound Stronger as Bank of England Makes No Move

The Great Britain pound was stronger today after the Bank of England performed no action during its monetary policy meeting. While the sterling did not manage to rise against all major peers, it gained on the safe currencies — the US dollar and the Japanese yen. As was expected, the BoE did not change monetary policy, announcing today: The Bank of Englandâs Monetary Policy Committee at its meeting today voted to maintain … “Pound Stronger as Bank of England Makes No Move”

Euro Higher After Volatile Trading

Things have been a bit volatile for the euro today. An ECB decision to stop accepting Greek bonds as collateral is rocking the region. However, even so, the euro has recovered and moved higher, even though at one point in the session it looked as though the 19-nation currency would slip below the 1.13 mark against the dollar. Earlier today, the European Central Bank announced that it would revoke a waiver allowing Greek … “Euro Higher After Volatile Trading”

Grexit Probability Higher Than In 2012; ECB Puts Pressure

The ECB surprised markets at a late hour and announced that Greek government bonds will no longer satisfy as collateral. This hurt EUR/USD. And what are the implications? The team at Barclays, that already talked about a 15 big figure fall for EUR/USD, now says that the chances of a Greek exit are now probably … “Grexit Probability Higher Than In 2012; ECB Puts Pressure”