The US dollar moved a bit lower against the Japanese yen recently, as the later one got bid across the board. There were some low risk events lined up in Japan today including the Securities investment, released by Ministry of Finance. The outcome was better than the market’s expectation, as it climbed to ¥675.2B from … “USD/JPY Holding An Important Level”

Month: February 2015

Canadian Dollar Pares Tuesday’s Gains

The Canadian dollar dropped against its major counterparts today, erasing yesterday’s gains. The currency dropped as prices for crude oil declined while concerns about global growth resulted in the market sentiment that was adverse to riskier commodity-related currencies. Futures for crude oil sank almost 7 percent in New York today as US inventories of crude continued to grow, reaching yet another record. Oil is the major export of Canada, … “Canadian Dollar Pares Tuesday’s Gains”

Yet Another Positive PMI Report Supports Sterling

The Great Britain pound ticked up today after yet another positive PMI report from the United Kingdom. The gains were relatively small compared to the yesterday’s rally as traders are cautious ahead of tomorrow’s policy decision of the UK central bank. The Markit/CIPS UK Services Purchasing Managers’ Index jumped from 55.8 in December to 57.2 in January, exceeding analysts’ expectations. The report followed yesterday’s positive construction PMI data. The Bank … “Yet Another Positive PMI Report Supports Sterling”

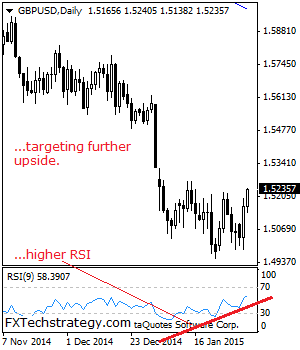

GBPUSD: Eyes Further Upside, bullish, February 4 2015

GBPUSD: Having maintained its bullish offensive, GBP faces the risk of further strength currently underway. On the upside, resistance resides at the 1.5300 level with a break aiming at the 1.5350 level. A violation will aim at the 1.5400 level and possibly higher towards the 1.5450 level. Its daily RSI is bullish and pointing higher … “GBPUSD: Eyes Further Upside, bullish, February 4 2015”

Negative interest rates: The new weapon in the forex

Quantitative easing has been around some seven years in its current form, but now another monetary policy tool is gaining momentum called negative interest rates. This is likely to become a weapon of choice in the currency wars and a key driver of exchange rates. Since the oil price plunge late last year (though it … “Negative interest rates: The new weapon in the forex”

PBoC Stimulating Measures Help Yuan Ignore Falling Services PMI

The Chinese yuan gained today even though the index of the services sector dropped significantly last month. The most likely reason for the rally was stimulating measures from China’s central bank. The HSBC China Services Business Activity Index dropped to 51.8 in January from 53.4 in December. While the gauge remained in the expansionary territory, the slowing growth was a bad sing nevertheless. The report followed data released earlier this week that … “PBoC Stimulating Measures Help Yuan Ignore Falling Services PMI”

US Dollar Index Pushes Higher

Even though there is some weakness to the dollar today, the dollar index is pushing higher. This is due, in large part, to the greenback’s gains against the euro (which is heavily weighted in the dollar index) and the Canadian dollar. The dollar has been struggling a little bit lately, thanks to disappointing economic data. Concerns about a slowing economic recovery have some thinking that maybe the Fed won’t raise rates … “US Dollar Index Pushes Higher”

New Zealand Dollar Gains on Employment & Wheeler’s Comments

The New Zealand dollar gained today after the release of employment data and comments of the central bank’s chief. The currency moved in a wide range, suggesting that trading was rather violent. New Zealand employment grew 1.2 percent in the December quarter from the previous three months, exceeding the median forecast of 0.8 percent. At the same time, the unemployment rate climbed from 5.4 percent to 5.7 percent, frustrating analysts who predicted a drop … “New Zealand Dollar Gains on Employment & Wheeler’s Comments”

Japanese Yen Holds on to Some of Its Gains

Japanese yen is holding on to some of its earlier gains, remaining higher against some of its major counterparts. However, there is still talk from Japanese policymakers that have the effect of weighing on the yen a little bit. Earlier, the yen got a bit of a boost with the release of PMI data. Markit shows that Japanese PMI came in at 51.3 in January. Even though that number was slightly down from … “Japanese Yen Holds on to Some of Its Gains”

AUD/USD: Trading the Australian Retail Sales February 2015

Australian Retail Sales is considered the primary gauge of consumer spending. The indicator provides analysts and traders with an early look at consumer spending. A reading that is higher than the market forecast is bullish for the Australian dollar. Here are all the details, and 5 possible outcomes for AUD/USD. Published on Thursday at 00:30 GMT. Indicator Background Consumer spending is … “AUD/USD: Trading the Australian Retail Sales February 2015”