The Chinese yuan ticked down today after the nation’s manufacturing sector contracted unexpectedly last month, leading to speculations about monetary easing from the China’s central bank. China’s manufacturing Purchasing Managers’ Index fell from 50.1 in December to 49.8 in January. A reading below 50.0 indicates contraction of the sector, and it was the first decline in more than two years. The services PMI declined as well though stayed in the expansionary zone. … “Yuan Declines as China’s Manufacturing Contracts”

Month: February 2015

AUDUSD: Faces Corrective Recovery Threats

AUDUSD: With AUDUSD halting its weakness on Friday, the past week (see daily chart) and triggering a recovery during Monday trading session, further recovery higher is now envisaged in the days ahead. On the downside, support resides at the 0.7700 level where a breach will aim at the 0.7650 level. Below that level will set … “AUDUSD: Faces Corrective Recovery Threats”

Euro Holds Its Own After PMI Data

Euro is holding its own against major counterparts right now, following the latest PMI data. The 19-country currency region showed some improvement in factory activity, and the euro is managing to gain ground today, even as worries about Greece continue to draw headlines. The eurozone PMI came in at a six month high for January, giving a reading of 51.0. A reading of 50 indicates the line between expansion (above) and contraction (below), so … “Euro Holds Its Own After PMI Data”

GBP/USD: Trading the UK Construction PMI February 2 2015

The British Construction PMI Index is based on a survey of Purchasing Managers in the construction industry. The survey includes about 170 respondents, who are surveyed for their view of a wide range of business conditions, including employment, new orders, prices and inventories. A reading which is higher than the market forecast is bullish for … “GBP/USD: Trading the UK Construction PMI February 2 2015”

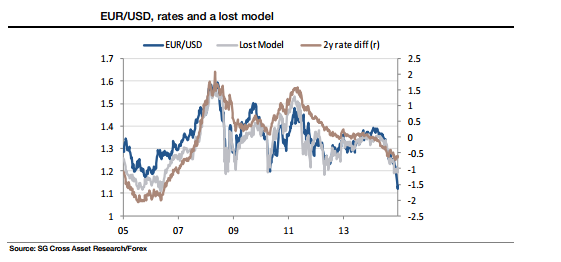

EUR/USD: Quieter Times Ahead?; Important Levels To Watch –

EUR/USD managed to stabilize after the big falls and is trading in a wedge. Does this imply quieter times? What levels should be watched? The team at SocGen discusses: Here is their view, courtesy of eFXnews: “…At the risk of using an out-of-date analytical tool to draw spurious conclusions, I would observe that the euro is about 6 ½ … “EUR/USD: Quieter Times Ahead?; Important Levels To Watch –”

Bleak outlook expected from RBA

More and more analysts are now predicting that the RBA is set to cut rates with 40% predicting that the first for the year may come as early tomorrow when the Central Bank announces their first interest rate decision for the year. One of the biggest names advocating for a rate cut is renowned business … “Bleak outlook expected from RBA”

FXTM launches Thai, Malay and Urdu language websites

FXTM, which was unscathed by the recent SNBomb, continues its expansion and launches websites in 3 new languages: Malay, Urdu and Thai. More details are in the press release here: International forex broker Forex Time (FXTM) has announced the expansion of its product offering, with the launch of three new languages – Urdu, Malay and Thai – on … “FXTM launches Thai, Malay and Urdu language websites”

Forex Crunch Key Metrics January 2015 – Record month

2015 began with a bang: Forex Crunch hit 900K page views, the best month ever, a big leap in comparison to previous months and a rise of 73% in comparison to January 2014. Also the number of unique users leaped to 214K, a jump of 167% in comparison to the previous year. The SNBomb alongside the ECB QE decision and … “Forex Crunch Key Metrics January 2015 – Record month”

USDCHF: Remains On The Offensive

USDCHF: With a second week of strength seeing further bullishness the past week, additional bull pressure is envisaged. However, watch out for a pullback following its two-week run to the upside. On the upside, resistance resides at the 0.9250 level where a break will aim at the 0.9300 level. Further out, resistance resides at the … “USDCHF: Remains On The Offensive”

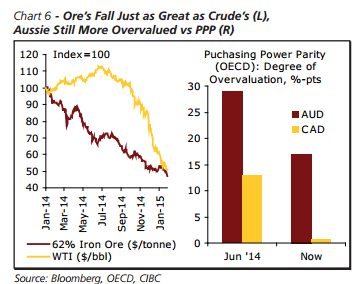

AUD: Will Stevens Borrow Poloz’s Clippers? – CIBC

The moment of truth is approaching for the Reserve Bank of Australia. After two months, the central bank convenes again. Will Stevens cut the interest rate? Where is AUD/USD headed to? Here is their view, courtesy of eFXnews: The AUD has been another currency succumbing to a resurgent USD over the last six months, depreciating by almost … “AUD: Will Stevens Borrow Poloz’s Clippers? – CIBC”