The Great Britain pound was very strong during the Wednesday’s trading session after the release of yet another positive macroeconomic indicator from the United Kingdom. The sterling remains firm during early Thursday’s trading. British Bankers’ Association reported that the number of mortgages approved for house purchases increased from 35,816 in December to 36,394 in January. The reading exceeded the median forecasts of market analysts. Macroeconomic data from Great Britain was … “Pound Remains Strong, Supported by Positive Data”

Month: February 2015

Lower Chances for Interest Rate Cut Mean Stronger CAD

The Canadian dollar gained today with the help of rising oil prices as well as yesterday’s speech from the central bank’s chief that made traders reevaluate chances for an interest rate cut. Stephen Poloz, Bank of Canada Governor, was talking at Western University, London, yesterday. He said that “decision to lower the policy interest rate last month was intended to take out some insurance” against “the risks facing both … “Lower Chances for Interest Rate Cut Mean Stronger CAD”

Yellen gave some food for USD bulls – June hike

The second part of Fed Chair Yellen’s testimony focused on regulatory questions, but there was an interesting monetary policy comment: Yellen sees inflation as falling lower before rising higher. This has implications on the rate hike. Here’s why. This comment reflects confidence that the fall in oil prices will only have a temporary effect on wider prices. More … “Yellen gave some food for USD bulls – June hike”

CNY devaluation would hit other Asian currencies hard

Could China’s CNY be the next domino to fall in the increasingly aggressive efforts by central banks to devalue their currencies? The People’s Bank of China holds considerable sway in the forex market and if it were to follow other Asian central banks an all out regional currency war could swiftly follow. The Eurozone, Japan … “CNY devaluation would hit other Asian currencies hard”

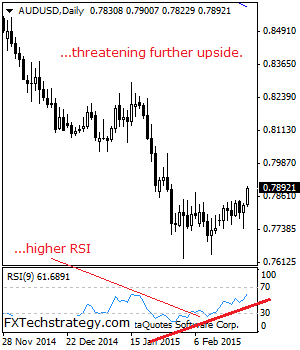

AUD/USD: Bullish, Extends Strength

AUDUSD: With AUDUSD following through higher on the back of its Tuesday gains during Wednesday trading session, further price extension is envisaged. On the upside, resistance lies at the 0.7950 level. A cut through here will turn attention to the 0.8000 level and then the 0.8050 level where a violation will set the stage for … “AUD/USD: Bullish, Extends Strength”

US dollar Continues to Struggle After Yesterday’s Remarks From Yellen

US dollar is still down today, following yesterday’s drop on the heels of remarks made by Fed Chair Janet Yellen to Congress. Many Forex traders have been considering that the Federal Reserve will raise interest rates sometime in 2015. However, the idea of a rate hike in the United States seems further away after the first day of Chairwoman Janet Yellen’s testimony to Congress. Yellen is testifying before Congress, as Federal … “US dollar Continues to Struggle After Yesterday’s Remarks From Yellen”

Hello Markets launches Security Token

Hello Markets launches a new security measure that helps defend brokers, using its new Security Token. This follows cases of employees stealing contact data of clients at brokerages. Here is more information from the official press release: World-leading financial solutions company Hello Markets is preparing to launch its new product in a series of new technological advances … “Hello Markets launches Security Token”

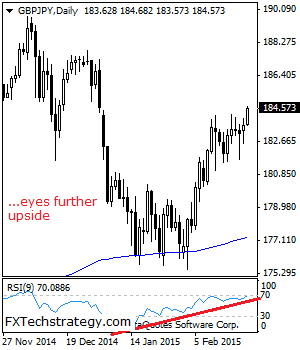

GBPJPY: Bullish, Strengthens Further

GBPJPY: The cross is seen following through higher on the back of its Monday gains suggesting further bullishness in the days ahead. On the upside, resistance lies at the 185.00 level followed by the 186.00 level where a break will aim at the 187.00 level. A cut through here will turn attention to the 187.00 … “GBPJPY: Bullish, Strengthens Further”

Yen Drops as Economic Data Trails Expectations

The Japanese yen fell today even though the nation’s corporate services price index last month. The possible reason for the drop is that the growth of the index was not as big as analysts promised. The Services Producer Price Index rose 3.4 percent in January from a year ago. While it was not a bad reading, it was still below the previous month’s increase by 3.5 percent and the median forecast of 3.6 percent. … “Yen Drops as Economic Data Trails Expectations”

NZ Dollar Fails to Rally due to Inflation Expectations

The New Zealand dollar sank during the current trading session after official data showed that inflation expectations worsened. The currency reached the lowest level in a week and a half against its US counterpart. The Reserve Bank of the New Zealand reported that short- and long-term inflation expectations deteriorated in the first quarter of this year. The data highlighted worsening outlook for the New Zealand economy. It had a clear impact on the NZ dollar as the currency … “NZ Dollar Fails to Rally due to Inflation Expectations”