The US dollar has not exactly continued its winning streak in recent weeks, and has had mixed results. Is it time for a renewal of the uptrend? The team at Bank of America Merrill Lynch thinks so. Here is there rationale, entry points and targets: Here is their view, courtesy of eFXnews: For the past … “Time To Buy The USD Index – BofA Merrill”

Month: February 2015

Dollar Ends Trading Mixed After Greek Debt Agreement

The US dollar ended the Friday’s session mixed. The currency was flat against the euro but gained on the Great Britain pound and was slightly up versus the Japanese yen. The main driver for the currency market today was news from Europe. The dollar was gaining on the euro during the first half of the trading session and due to reports that the European Central Bank made a contingency plan for Greece’s exit from the eurozone. But rumors … “Dollar Ends Trading Mixed After Greek Debt Agreement”

Euro Bounces After Reports About Greek Bailout Agreement

The euro was rather weak during the most part of the current trading session due to uncertainty about Greece and its future in the eurozone. Yet the currency bounced after reports that the Greek government and the European Union official were able to reach some form of compromise. There were reports that the eurozone finance ministers made a draft of loan extending agreement for Greece, though there are still no official announcements. It … “Euro Bounces After Reports About Greek Bailout Agreement”

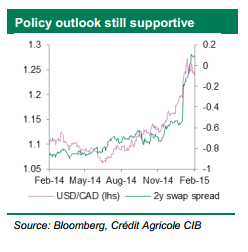

Staying Long USD/CAD For 1.3050; Staying Bearish On CAD

The Canadian dollar flipped up and down on oil prices, still uncertain about the next steps of the Bank of Canada. The team at Credit Agricole sees further depreciation of the C$ and sets a target: Here is their view, courtesy of eFXnews: The CAD has been in demand for most of the last few … “Staying Long USD/CAD For 1.3050; Staying Bearish On CAD”

Canadian Dollar Bounces Back After Earlier Losses

Canadian dollar was losing ground to its major counterparts earlier, but now the loonie has bounced back a bit. Speculation about the eurozone, along with concerns about what’s next for the US dollar, not to mention the results of profit taking, are helping the Canadian dollar inch a bit higher. Canadian dollar plunged lower, along with oil prices, in trading yesterday and earlier today. With supply data from … “Canadian Dollar Bounces Back After Earlier Losses”

3 bearish EUR/USD scenarios for 3 Different Greek Outcomes

The plot thickens around the Greek crisis and the clock continues ticking quickly. How will this affect the euro? The team at Goldman Sachs lays out the scenario and see the risk reward tilted firmly to the downside: Here is their view, courtesy of eFXnews: In a note to clients today, Goldman Sachs discusses how EUR/USD … “3 bearish EUR/USD scenarios for 3 Different Greek Outcomes”

Questions for traders, State of Fed, Greek crisis, oil,

A packed show awaits you, our listeners, in which we cover a wide variety of market moving events, covering commodities, the next moves in the dollar, euro and pound as well as a time for pausing and reflecting on trading strategies. Tune in. Welcome to a new episode of Market Movers, presented by Lior Cohen of … “Questions for traders, State of Fed, Greek crisis, oil,”

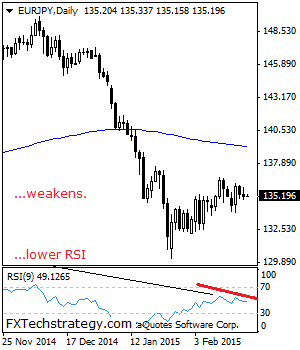

EURJ/PY remains vulnerable to the downside

EURJPY- With the cross remaining weak and vulnerable to the downside, risk continues to point lower. On the upside, resistance resides at the 136.68 level where a break if seen will threaten further upside towards the 137.50. Further out, resistance resides at the 138.00 level where a break will aim at the 139.00. On the … “EURJ/PY remains vulnerable to the downside”

EUR/USD: Bearish short and long term – Citi

EUR/USD is reacting to every headline regarding Greece and seems to be looking for a direction. The team at Citi examine the charts and see a clear direction: down. Here is the rationale and the targets: Here is their view, courtesy of eFXnews: On long-term charts, EUR/USD remains below the 200 month moving average, which … “EUR/USD: Bearish short and long term – Citi”

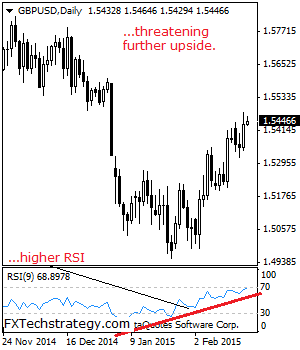

GBPUSD: Bullish On Correction

GBPUSD: With GBP strengthening on Wednesday, further bullishness is likely in the days ahead. On the downside, support lies at the 1.5400 level where a break if seen will aim at the 1.5350 level. A break of here will turn attention to the 1.5300 level. Further down, support lies at the 1.5250 level. Conversely, resistance … “GBPUSD: Bullish On Correction”