US dollar is heading lower again following an earlier surge in value relative to its major counterparts. Earlier, the greenback saw gains, especially against emerging market currencies. Now the dollar is pulling back a bit, especially against its major counterparts. Profit taking is one of the factors contributing to the greenback’s lower performance against its major counterparts right now. Earlier, the US dollar surged a bit against … “US Dollar Heads Lower After Earlier Surge”

Month: February 2015

EUR/USD: Trading the Preliminary German GDP February 2015

The German Preliminary GDP measures growth in the economy. GDP measures production and growth of the economy. A reading which is higher than the market forecast is bullish for the euro. Update: German GDP grew 0.7% in Q4 – much better than expected Here are all the details, and 5 possible outcomes for EUR/USD. Published on Friday at 7:00 … “EUR/USD: Trading the Preliminary German GDP February 2015”

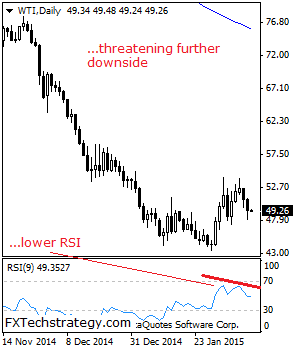

CRUDE OIL: Vulnerable, Weakens Further

CRUDE OIL: With price extension seen on Wednesday, further downside pressure is likely. On the downside, support lies at the 48.00 level where a break will expose the 47.00 level. A break will aim at the 46.00 level and then the 45.00 level. A turn below here will open the door for a run at … “CRUDE OIL: Vulnerable, Weakens Further”

Canadian Dollar Attempts to Hold Ground Despite Falling Oil

The Canadian dollar dropped today, declining for the second consecutive session against its US counterpart and the euro, following the slump of prices for crude oil — the major Canada’s export commodity. The loonie is trying to hold ground though, and the currency trimmed its losses as of now. Prices for crude oil halted its recent rally and were declining for several days due to concerns about oversupply. The Canadian currency often tracks moves of oil prices, … “Canadian Dollar Attempts to Hold Ground Despite Falling Oil”

Greek crisis: Hamburg elections part of Germany’s hard line

Some say that all politics are internal ones, and that that influences external decisions. This may be the case in the current intensive negotiations between Greece and its European creditors led by Germany. German finance minister Wolfgang Schäuble is leading the tough stance, basically rejecting in public any proposal that is different from the terms agreed upon … “Greek crisis: Hamburg elections part of Germany’s hard line”

Euro Mostly Lower Against Majors as EU Leaders Meet

European Union leaders and policymakers are meeting today and tomorrow to try and figure out what should be done about Greece. Speculation about what could be next means a wary euro that is mostly lower against its major counterparts. Today, finance ministers from the eurozone are meeting to discuss various issues afflicting the eurozone, especially concerns about Greece. Greece’s finance minister is expected, … “Euro Mostly Lower Against Majors as EU Leaders Meet”

AUD/USD: Trading the Australian jobs Feb 2015

Australian Employment Change, which is released monthly, provides a snapshot of the health of the Australian labor market. A reading which is higher than the market forecast is bullish for the Australian dollar. Here are the details and 5 possible outcomes for AUD/USD. Published on Thursday at 00:30 GMT. Indicator Background Job creation is one … “AUD/USD: Trading the Australian jobs Feb 2015”

Japanese Yen Finds No Support from Risk-Negative Sentiment

The Japanese yen dropped against its major counterparts today even as the market sentiment was not particularly favorable to risk and should have boosted safe haven assets. The yen is considered to be a safe currency and often rallies in times on fear and uncertainty. With troubles in Greece and poor economic indicators from China, one could assume that the Japanese currency would rise. Yet this has not came to pass. … “Japanese Yen Finds No Support from Risk-Negative Sentiment”

Market Sentiment & Drop of Oil Prices Drag Canadian Dollar Down

The Canadian dollar dipped today because of the risk-negative sentiment prevalent on the Forex market as well as due to the drop of crude oil prices. The loonie, as most other currencies, attempted to rally against the Japanese yen at the beginning of the current trading session but failed and trades below the opening level as of now. Concerns about Greece and its potential exit from the eurozone continue to make traders nervous and less willing to risk. The recent string on negative economic … “Market Sentiment & Drop of Oil Prices Drag Canadian Dollar Down”

GBP Steady vs. USD, Rallies vs. JPY

The Great Britain pound was steady against the US dollar but rallied versus the Japanese yen together with most other major currencies today even though macroeconomic indicators from the United Kingdom missed analysts’ projections, highlighting difficulties that the British economy is experiencing. Industrial production fell 0.2 percent in December from November instead of rising 0.3 percent as was predicted by experts. While manufacturing production … “GBP Steady vs. USD, Rallies vs. JPY”