The euro demonstrated massive losses on Tuesday with not-so-good economic data, the continuing problems in Greece and the economic stimulus from the European Central Bank. The shared 19-nation currency was set to have its worst quarter in the history. The reasons for the euro’s drop were largely the same as yesterday — the debt woes of Greece and the quantitative easing program of the ECB. Unlike the previous session though, the euro sank against all its rivals, not just the dollar, … “Euro Logs Massive Drop on Tuesday”

Month: March 2015

Canada’s GDP Shrinks, Canadian Dollar Unfazed

Canada’s economy shrank at the start of the current year as was demonstrated by today’s report from Statistics Canada. Yet in a surprising display of resilience the Canadian currency jumped after the report instead of falling. Canadian gross domestic product fell 0.1 percent in January after rising 0.3 percent in December. It was not a good reading yet the Canadian dollar jumped sharply after the economic release. The possible reason for such behavior is … “Canada’s GDP Shrinks, Canadian Dollar Unfazed”

Great Britain Pound Gets Lift from Positive Revision to GDP

The Great Britain pound was lifted by the positive revision to UK gross domestic product. With little positive news for the currency lately, it was enough to help the sterling gain even on the strong dollar, let alone on the very vulnerable euro. UK GDP rose 0.6 percent in the fourth quarter of 2014 according to the final estimate versus 0.5 percent in the previous evaluation. Other economic indicators were good as well for the most part. … “Great Britain Pound Gets Lift from Positive Revision to GDP”

Australian Dollar Under Pressure, Attempts to Fight

The Australian dollar remained under downside pressure today, falling to the lowest level since March 18 against the US dollar and to the weakest since February 5 versus the Japanese yen. Currently, the Aussie fights the pressure, managing to trim its losses. With the US dollar gaining strength, other currencies found themselves in a difficult situation. Additionally, the rally of the greenback had an adverse effect on commodities, and the Aussie’s performance is linked to that of raw … “Australian Dollar Under Pressure, Attempts to Fight”

AUD/USD: Trading the Australian trade March 2015

Australian Trade Balance is closely linked to currency demand and is a key indicator. A reading which is higher than expected is bullish for the Australian dollar. Here are all the details, and 5 possible outcomes for AUD/USD. Published on Thursday at 00:30 GMT. Indicator Background Australian Trade Balance is measures the difference in the value of imported and … “AUD/USD: Trading the Australian trade March 2015”

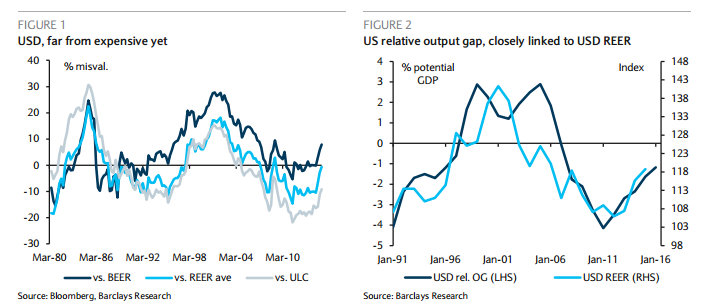

How High Can The USD Go? EUR/USD to 0.98 by

Not only Goldman Sachs sees EUR/USD below parity. The team at Barclays analyzes the value of the US dollar, asking whether the greenback is overvalued and if it can run just a little bit further. Here is their interesting analysis: Here is their view, courtesy of eFXnews: A major questions among market participants right now … “How High Can The USD Go? EUR/USD to 0.98 by”

FXStreet and FxPro kick off a new advertisement model

A beginning of a new era in forex advertising? Leading forex portal FXStreet reached an agreement with FxPro, a large forex broker, on a new advertisement model. FXStreet is beginning to implement the new vision on how to engage with partners and users. The portal aims to experiment with new placements and formats, generating new synergies … “FXStreet and FxPro kick off a new advertisement model”

GBP/USD Trading the British Manufacturing PMI

The British Manufacturing PMI (Purchasing Managers’ Index) is based on a survey of purchasing managers in the manufacturing sector. Respondents are surveyed for their view of the economy and business conditions in the UK. A reading which is higher than the market forecast is bullish for the pound. Update: UK Manufacturing PMI hits 54.4 – within expectations – GBPUSD … “GBP/USD Trading the British Manufacturing PMI”

Euro Will Fall In A Cyclical Upswing: Why & Where

EUR-USD begins slipping out of range and is trading at the 1.07 handle. The team at Goldman Sachs has already lowered forecasts, and now focuses on targets for the shorter term: Here is their view, courtesy of eFXnews: The recent revision higher of Euro area growth and inflation forecasts by both policy makers and private … “Euro Will Fall In A Cyclical Upswing: Why & Where”

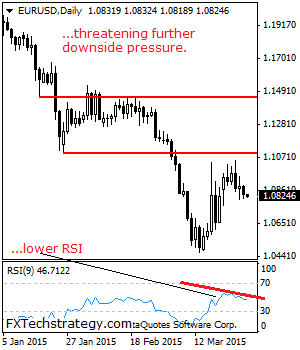

EURUSD: Maintains Downside Threats

EURUSD: With EUR continuing to look vulnerable, further downside pressure remains. Resistance is seen at the 1.0900 level with a cut through here opening the door for more downside towards the 1.0950 level. Further up, resistance lies at the 1.1000 level where a break will expose the 1.1096 level. Its daily RSI is bearish and … “EURUSD: Maintains Downside Threats”