The ECB is about to commence with its massive QE program. Is it already priced in or has the euro more room to run down?

Vassili Serebriakov from BNP Paribas explains why the pair could further fall:

Here is their view, courtesy of eFXnews:

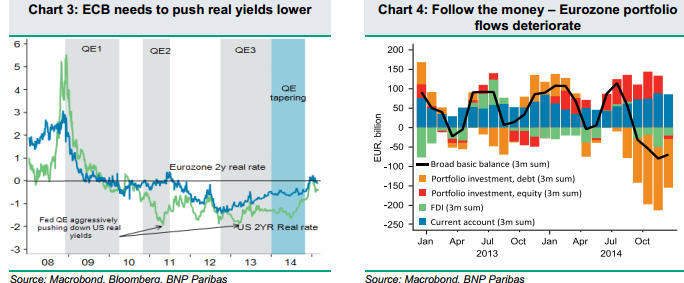

“As the ECB prepares to launch its full-scale QE programme next month, some market participants are questioning the rationale for further EUR weakness, arguing that the ‘announcement effect’ has been largely priced in and that the rebound in the eurozone data suggests the currency may have troughed. We disagree. First, ECB QE will overlap with Fed and BoE tightening, implying that we have not seen the end of policy divergence. Second,even in the absence of further ECB policy surprises this year, the Fed’s experience with unconventional easing suggests the ‘flow effect’ of QE can also be a major driver of broad-based currency weakness provided it anchors nominal yields and lifts inflation expectations.

Finally, from a tactical trading perspective we note the following:

–Positive data should offer little help the EUR in the absence of yield support. Instead we argue for selling the EUR against currencies with strong economic ties to the eurozone and/or using EUR as a funding currency for risk-on trades.

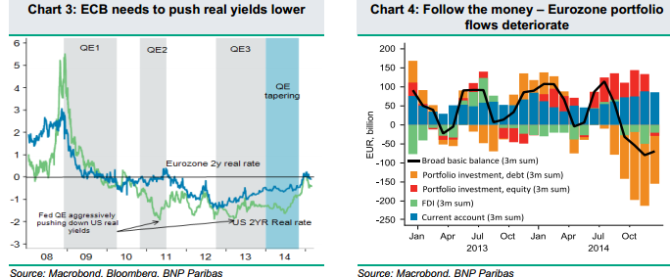

–Portfolio flows data, particularly foreign asset purchases by eurozone investors will remain a key gauge for the EUR. Similarly, BNP Paribas Postitioning Analysis should indicate the extent of the EUR-funded carry trade”

Vassili Serebriakov – BNP Paribas

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.