After some range trading for the US dollar during February, what’s next for the greenback?

Here are views on the themes that are set to rock the US dollar and forecasts for a few pairs:

Here is their view, courtesy of eFXnews:

The following is Bank of America Merrill Lynch’s comprehensive outlook for the USD including its themes, forecasts, and risks.

Themes: economic strength, policy divergence support USD.

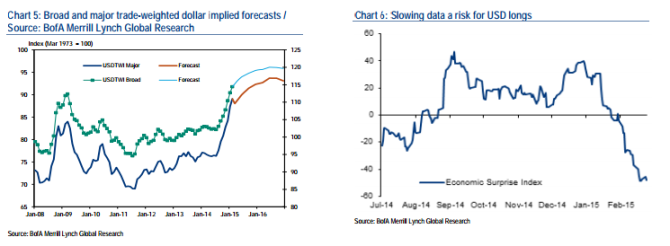

The dollar broadly traded in a range in February as speculative investors pared back USD longs in 4 of the past 5 weeks. This is consistent with our view that stretched USD positioning could limit near-term upside. Chair Yellen remained optimistic about the economy in her Semi-Annual Congressional testimony, but given concerns about a premature tightening of financial conditions took on a more balanced tone than the market expected. However, we continue to expect policy divergence to be a continued driver of USD strength over the balance of 2015, evidenced by the 280,000 pace of non-farm payrolls growth.

Additionally, overseas policy is moving in the other direction with the Reserve Bank of Australia cutting rates and the Riksbank cutting rates and engaging in small-scale QE, pushing policy divergence from both sides of the coin. Despite the medium-term picture for policy divergence playing out largely as we expect, long USD positioning is still significant, while US data surprises have decelerated aggressively. We think the trade is vulnerable to shocks as its unlikely both legs of the decoupling trade (higher equities and USD) can continue without creating problems.

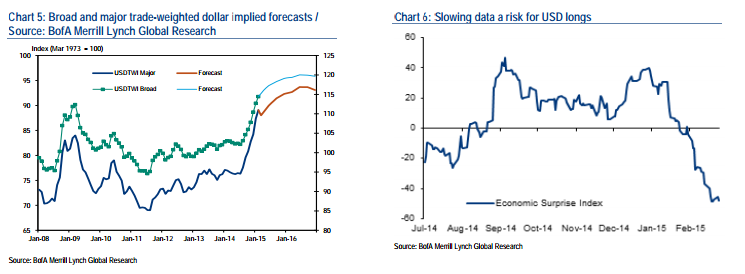

Forecasts: still expecting broad USD strength

We leave our core G3 forecasts unchanged, expecting EUR-USD and USD-JPY to finish the year at 1.10 and 123 respectively. Outside of the G3, in dollar-bloc, we bring expected AUD depreciation forward, now expecting AUD-USD to finish 2015 at 0.73 (from 0.77). All other G10 forecasts remain unchanged. In EM, we have incremental changes, pushing up some forecasts for USD-CNY, USD-MXN and USD-BRL.

Risks: inflation.

A continued decline in realized and forward inflation in the US would keep the Fed on hold and delay the timing of our expected USD appreciation.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.