Euro/dollar continues falling, with 1.08 already seen from above. On this background, the team at Credit Suisse revises down its targets.

Here is their explanation as why the meltdown is far from over in the pair:

Here is their view, courtesy of eFXnews:

For the second time this year, Credit Suisse has revised down its EUR/USD forecasts in the aftermath of the ECB meetings.

EUR: Structural Shift:

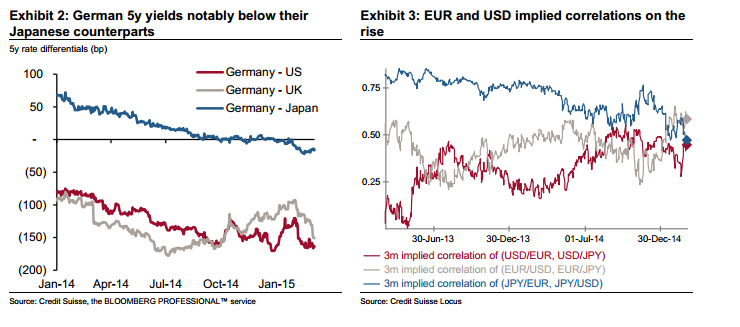

CS argues that the extensive scope of sovereign QE in the euro area could catalyse a structural and persistent shift from EUR. CS thinks that anecdotal evidence between January’s and last week’s ECB meeting has supported this idea, with European investors seemingly keen to pick up yield overseas and with overseas companies rushing to issue debt in negative-yield currencies such as EUR and CHF to exploit low yields.

“Last week’s ECB meeting appeared to add fuel to the fire by suggesting implicitly that ECB officials were hopeful that foreign-owned European debt could help alleviate any supply shortages arising from sovereign QE. And the formal introduction of the negative rate floor on bond purchases keeps alive a flattening bias for European rates – allowing the market to price in wider US vs euro area forward rate differentials,” CS clarifies.

EUR: New Forecasts:

“We are revising our EURUSD forecast set to 1.05 in 3m (1.09 prior) and 0.98 in 12m (1.02 prior),” CS projects.

EUR: Short Across The Board:

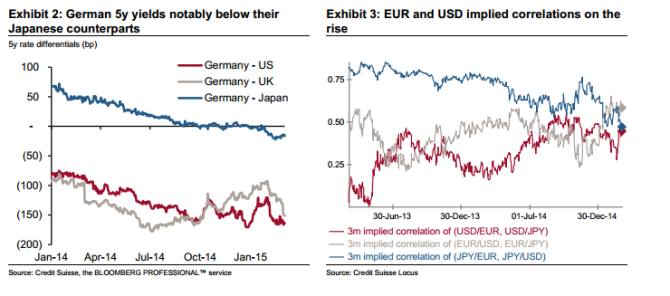

“In addition, we are now of the view that the market is increasingly willing to hold short EUR positions on crosses in G10 space as well.. If EUR really does replace JPY as the funding currency of choice due to negative rates, this trend can have a lot further to run, to EUR’s overall detriment,” CS adds.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.