The US dollar enjoyed yet another strong surge, sweeping also currencies that had showed resilience beforehand.

Is it over? Not so fast. The team at CIBC explains the motives and the timing for the next leg up in the greenback, that may be the last for this cycle.

Here is their view, courtesy of eFXnews:

All good things must come to an end, even a remarkable bull run in the USD, says CIBC World Markets.

‘The market has yet to fully account for rapidly approaching Fed hikes, the first of which should come by June. That will give a last leg to USD strength, before better news overseas allows other majors to hold ground versus the greenback,” CIBC argues.

“The FOMC meets on the 17th and 18th, and the committee should be ready to drop “patience” from its message on rates. That’s likely to serve as a wake-up call to the bond market, and in the process start the last leg of greenback strength,” CIBC projects.

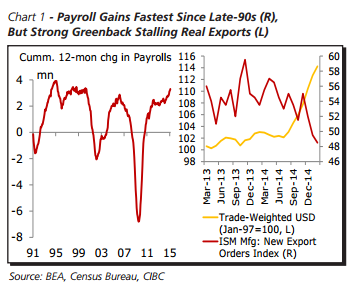

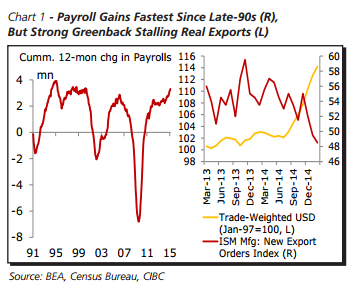

Morover, CIBC The evidence is beginning to build that the dollar is overshooting what the US can sustain on the trade side, particularly if oil rebounds and raises nominal imports.

“Export orders have started to languish, denting the performance of the real economy. Exporters are also registering a visible dent to profits, the key longer term driver for capital spending, as foreign sales get translated into fewer greenbacks,” CIBC clarifies.

Further into the year, CIBC thinks that the payoffs from monetary stimulus could be more visible in the performance of overseas economies.

“Not that they will outperform the US or raise rates for several years to come, but enough that there won’t be fresh downside surprises to keep the dollar on the rise,” CIBC argues.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.