The US dollar enjoyed a nice rally against many currencies in anticipation of Fed tightening. We will probably get a change in wording this week.

How can we prepare for it? Which currency pair is likely to move most? Vassili Serebriakov from BNP Paribas answers:

Here is their view, courtesy of eFXnews:

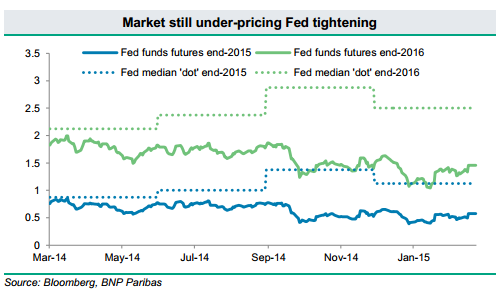

“The FOMC policy announcement on Wednesday 18 March will be pivotal for the currency (FX) markets. We expect the statement to drop the “patient” reference, but suspect the Fed will be careful in re-iterating data dependence.

In light of the USD’s surge, Chair Yellen may use the press conference to point out that exchange rate effects matter for growth and inflation and, hence, the timing and pace of Fed policy normalization. This would reduce the likelihood of a June hike.

Our economists continue to see September as more likely.

However, any resulting USD pullback should be temporary.

We have taken profit on our short EURUSD trade, but remain long USDJPY with a 125 target.”

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.