The dollar suffered a blow across the board as Janet Yellen and her colleagues released dovish notes. Some see the beginning of the end for the USD rally, but this is certainly not the only opinion.

The team at BNP Paribas discuss the new phase of the USD bull market:

Here is their view, courtesy of eFXnews:

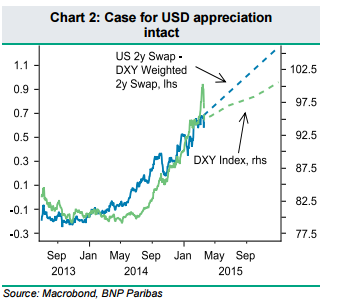

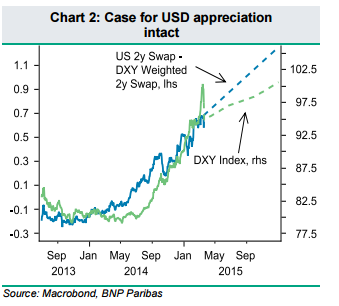

“When the dust settles, we think the strong USD consensus will remain very much intact and there will be good interest to add to USD longs at current levels.

The Fed remains on track to hike rates in 2015, with all but three of committee members expecting to hike by at least 50bp. Moreover, the rates market is once again significantly underpricing the Fed’s 2016 and 2017 projections for the policy rate, suggesting markets have perhaps overreacted to the lowering of the other projections provided. The Fed is clearly sensitive to the impact of the USD on inflation and this should help limit USD upside momentum as we approach the first Fed hike.

The USD will likely trade with a greater sense of two-way risk and appreciate less rapidly than it did over the past three months. Nonetheless, the underlying rationale for USD appreciation remains in place and we expect to see good interest to rebuild USD longs at these post-Fed levels in EURUSD and USDJPY.”

Daniel Katzive – BNP Paribas

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.