EUR/USD managed to bounce back, but it isn’t exactly stable right now: volatility is rising and the pair is looking for a new direction.

The team at Nordea examine the turning points for the pair:

Here is their view, courtesy of eFXnews:

Blame the US economic data disappointments for the recent strength in USD and lower yields. Are we there yet?!

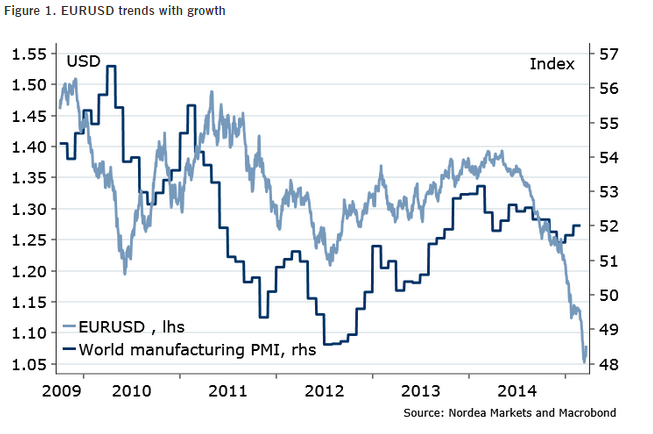

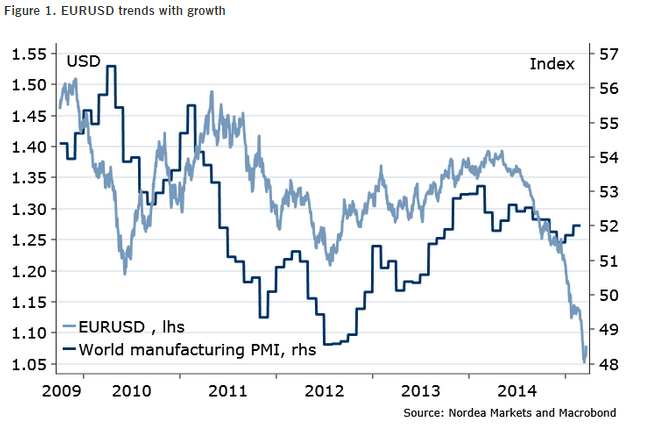

Many have associated the USD strength since last year with the “policy divergence”. Me? I blame it on the worsening global growth momentum primarily. The USD has always performed in slowing global growth and rising volatility environments, and this cycle is no exception.

The USD uptrend challenged? We are starting to see improvements in global growth data, notably Europe, Japan. And, strangely enough, if there is anything holding the global cyclical upswing back (and thus keeping conditions ripe for further USD strength and lower rates), it is the weaker US data. By now the negative US data surprises have become largest among G10, largest since 2009, and last time it was this bad was when… Fed launched QEs. But since forecasts and sentiment adjust to the data, should we see the US data stop disappointing us soon?

Tailwinds from Europe. PMIs, key global growth momentum indicator, are this week’s focus. At least the European data is on the steady improvement track. We will hear more good news in the coming months, as money supply, stock price and other data suggest. Actually, it is the euro area that has been fuelling global growth forecast revisions upward this year, so far outweighing the cuts in the US growth. Notably, Draghi has also blessed the positive changes, finally – an important shift, to my mind.

Fed talk helps. They blinked – pushed back to temper the USD strength last week (1.10 target reached). The US Inflation figures are out this week, one more negative print (-0.1% y/y) for the headline inflation. And they do care! Yellen admitted last week that strong USD is pulling inflation down “at least on a transitory basis“. Fed’s Lackhart (voting dove) was the first after the Fed meeting to explain himself (“I have raised my level of concern about a strong dollar”). Expect to hear more in the week ahead – Fischer, Yellen, Evans, Bullard to speak up. No doubt, the USD is at the center of policy discussion right now.

It is always volatile at the turning points. And only when it’s dark enough you can see the stars. Once the US data stops disappointing, that’s when we can trust this “Fed fuelled” USD fall can continue, and last. Until then, a correction toward 1.12 in EURUSD (baseline), and only below 1.0450 the (sub-)parity calls can be brought back on the table.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.