The US dollar has strengthened quite a lot in anticipation of a rate hike, and also due to convergence with other central banks that took the other path.

What will happen in the day after? The team at HSBC observe the situation and reach a clear conclusion:

Here is their view, courtesy of eFXnews:

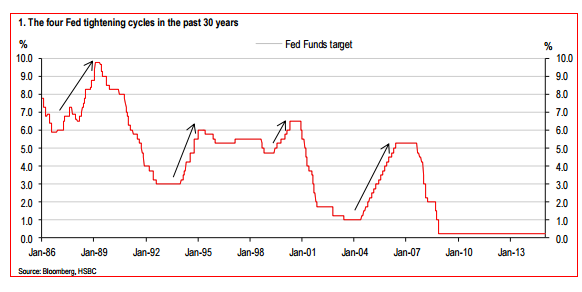

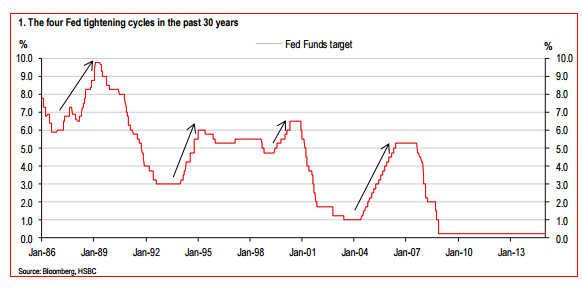

“The overall impact of a Fed tightening cycle on the dollar depends on whether the tightening is driven by concerns over inflation or to restrain a strong economy. In the former case, the dollar tends to weaken; in the latter case it tends to strengthen. Arguably, the current motivation for the upcoming tightening is neither driven by fears of excessive growth or rampant inflation,” HSBC argues.

“Thankfully, whatever the overall impact, however, on each of the four previous tightening cycles seen in the past 30 years, the dollar has fallen in the period immediately after the first rate rise. This “buy the rumour, sell the fact” behaviour during a tightening cycle suggests that one should be cautious about expecting too much in the way of further dollar strength should the Fed move to raise rates later this year,” HSBC warns.

“The fact that policy in the US is diverging from policy at other major central banks is not unusual – three of the four previous Fed tightening cycles have also seen policy divergence. However, whereas dollar strength has previously made overseas central banks more likely to follow the Fed with higher rates, the continued risk of deflation makes that much less likely this time round,” HSBC adds.

All in all, HSBC advises against buying the USD when the Fed starts raising rates.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.