Not only Goldman Sachs sees EUR/USD below parity. The team at Barclays analyzes the value of the US dollar, asking whether the greenback is overvalued and if it can run just a little bit further.

Here is their interesting analysis:

Here is their view, courtesy of eFXnews:

A major questions among market participants right now is whether the bulk of the USD rally now stands behind us.

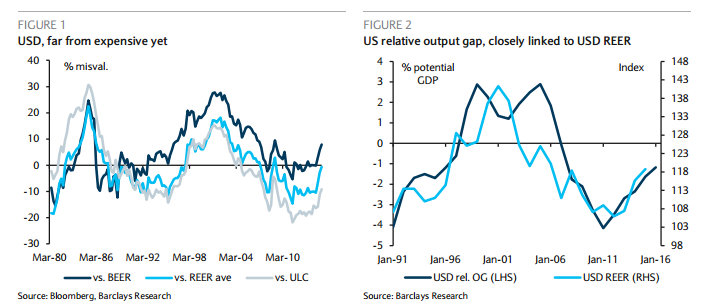

To answer this question, Barclays Capital presents three alternative measures of USD valuation: REER relative to its average, unit labour cost relative to US trading partners, and Barclays measure of currency misalignment relative to the USD long run fair value.

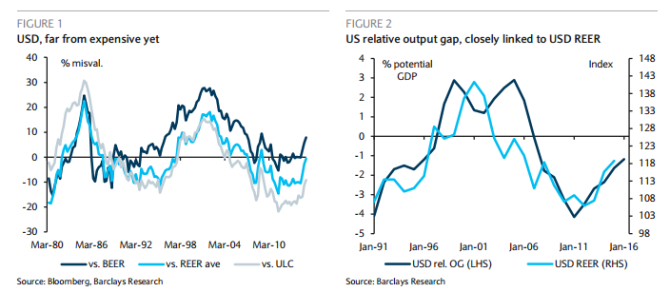

“While our BEER model suggests that the USD is 9.6% overvalued, equivalent to a 0.9 standard deviation move relative to fair, we anticipate that the misalignment could move into the 1.5- 2.0 standard deviation range relative to fair value as the US business cycle continues to improve ahead of a sluggish world. Indeed the USD REER seems to be strongly correlated with the US output gap relative to its trading partners, ” Barclays notes.

“Under all other valuation metrics, the USD seems to have even more room for appreciation, which should ease valuation concerns from the USD path in the near term, in our view,” Barclays finds out.

All in all, Barclays acknowledges that the risk-reward in long USD positions has deteriorated, but believes there is still substantial room for further upside in the USD as its valuation is far from stretched and cyclically the US economy is still poised to outperform.

In line with this view, Barclays forecast 5% USD REER appreciation by year-end, and sees EUR/USD at 0.98 around the same time.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.