So, the euro is recovering, isn’t it? Well, perhaps not for too long. The general downtrend seems to be intact. The team at Dankse explain why more losses are awaiting EUR/USD: Here is their view, courtesy of eFXnews: “We have been forecasting EUR/USD to fall in H1 and bounce in H2. That is still our … “EUR/USD; Further Loses Ahead; Positioning Not A Hinder –”

Month: March 2015

Yet One More Week of Massive Gains for US Dollar

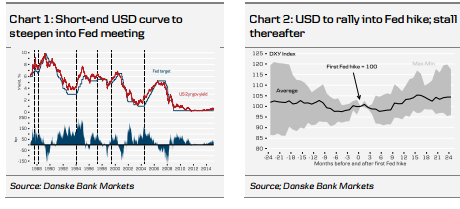

The US dollar continued to demonstrate an amazing performance this week, mainly due to the outlook for an early interest rate hike from the Federal Reserve. The currency posted especially big gains versus the euro and the Great Britain pound. The dollar had stellar performance last week, and analysts predicted even more gains for this week. Their forecast proved to be correct after the US currency surged to new multi-year highs against the euro … “Yet One More Week of Massive Gains for US Dollar”

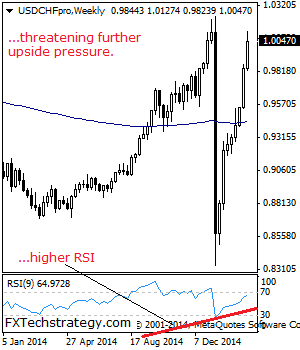

USDCHF: Extends Bullishness

USDCHF: With the pair extending its bullishness the past week, further strength is envisaged in the new week. Although USDCHF may see a corrective pullback following its recent strength. Resistance resides at the 1.0100 level with a breach targeting the 1.0150 level. A breather may occur here and turn the pair lower but if taken … “USDCHF: Extends Bullishness”

Bank of Russia Cuts Key Rate, Sending Ruble Down

The Russian ruble dropped today after the central bank made a decision to reduce its key rate as inflation pressure abated. The ruble was strengthening lately following the earlier plunge due to sanctions from the United States and the European Union. The Bank of Russia announced today: On 13 March 2015, the Bank of Russia Board of Directors decided to reduce the key rate from 15.00 to 14.00 percent per annum taking into account that … “Bank of Russia Cuts Key Rate, Sending Ruble Down”

Euro Collapses to New Lows as Traders Flee to Safety

The euro tumbled across the board today as the risk-negative market sentiment added to the downside pressure that the currency was already experiencing. The euro dropped to the lowest level in 11 years against the US dollar and the lowest in 9 years versus the Great Britain pound. Traders were already cautious due to the upcoming Federal Reserve meeting, and the current trading session made them even more averse to risk after US economic data trailed … “Euro Collapses to New Lows as Traders Flee to Safety”

Yen Gains Against Major, Except for Dollar

The Japanese yen followed the US dollar in a rally ahead of next week’s monetary policy meeting of the Federal Reserve. The yen demonstrated gains against most other major currencies, with the obvious exception of the dollar against which the Japanese currency was flat. Traders are readying for the Fed meeting and speculate about possible actions US policy makers may take. The resulting risk-averse sentiment was driving higher the currencies perceived to be … “Yen Gains Against Major, Except for Dollar”

Pound Drops After Carney’s Comments

The Great Britain pound tumbled today, reaching the lowest level since June 2010 against the US dollar, after the central bank’s chief signaled that the planned interest rate hike will likely be postponed. Mark Carney, Governor of the Bank of England, said in an interview today that, while he is optimistic about the nation’s economy, there is no hurry for raising interest rates. Considering that prospects for a rate … “Pound Drops After Carney’s Comments”

Canadian Dollar Struggles Along With Oil

Oil continues to struggle in the markets, and that is bringing the Canadian dollar lower as well. Right now, loonie continues to drop against the greenback, even though it (like every other currency) is higher against the euro. The only major currency that loonie is gaining against right now is the euro. Against other currencies, the Canadian dollar isn’t doing as well. The loonie is having especial problems with … “Canadian Dollar Struggles Along With Oil”

US Dollar Resumes Its Rally

US dollar has resumed its rally, heading higher again after yesterday’s breather. Greenback is once again up against its major counterparts, gaining ground as rumors about a Fed rate increase swirl. Forex traders are looking to better data as an indication that the Federal Reserve is getting ready to hike rates. The employment situation, while still not ideal, is improving, and that has long … “US Dollar Resumes Its Rally”

QE: Who got it right, Krugman or the Gold bugs?

This episode of Market movers is dedicated to Quantitative Easing (QE). This happens as the “QE baton” is passed from the Federeal Reserve to the ECB. These banks are not alone. We define and explain it, review the main uses, the benefits and the secondary effects. Does it really work? Will central banks know how to unwind … “QE: Who got it right, Krugman or the Gold bugs?”