The Bank of Thailand followed many other central banks of emerging economies in cutting its borrowing costs. The Thai baht suffered as a result of the monetary policy decision but managed to bounce versus the US dollar. Like the Bank of Korea, the Bank of Thailand decided to reduce its main interest rate. What is more, the reduction was exactly the same — by 25 basis points to 1.75 percent. Unlike the South Korean won though, the Thai … “Thai Baht Lower After Central Bank Cuts Borrowing Costs”

Month: March 2015

Won Gains Even as Bank of Korea Cuts Base Rate

The South Korean won rallied today even though the nation’s central bank cut its Base Rate unexpectedly. The most likely reason for the rally was the weakness of the US dollar, though the won gained versus the euro as well. The Bank of Korea decided to cut its main interest rate by 25 basis points to 1.75 percent at today’s policy meeting. The central bank was a bit pessimistic about the global economy, saying in the statement: … “Won Gains Even as Bank of Korea Cuts Base Rate”

EUR/USD: UOM Consumer Sentiment March 2015

The University of Michigan Consumer Sentiment Index surveys consumer attitudes and expectations about the US economy. An increase in consumer confidence is a positive sign about the health of the economy and is bullish for the US dollar. Update: US consumer confidence slides to 91.2 – USD pauses (for now Here are all the details, … “EUR/USD: UOM Consumer Sentiment March 2015”

Turkish Lira Gains as Erdogan Meets Basci

The Turkish lira gained today as central bank Governor Erdem Basci met President Recep Tayyip today, giving hope that criticism of the bank’s policy will be tone down. Turkish authorities were criticizing the Central Bank of the Republic of Turkey lately for not performing deeper interest rate cuts. Yet it looks like they are backing off now after the lira dropped more than 10 percent … “Turkish Lira Gains as Erdogan Meets Basci”

Euro Takes a Breather, Gains Against Majors

Euro is a little higher against its major counterparts today, taking a breather after a major slide this week. Indeed, things seem to be calming down this week following dramatic performances from both the euro and the US dollar. Euro has been in a dive this entire week. The start of the ECB’s quantitative easing program, just when the United States is getting ready to hike rates, was such … “Euro Takes a Breather, Gains Against Majors”

Dollar Index Lower After Touching 100

US dollar index is slightly lower on the day, falling back after touching 100. The US dollar index hit a high not seen since April 2003, rallying as the greenback is seen as the most viable currency in the world. Right now, the dollar is lower against its counterparts, due in large part to profit taking. However, analysts think that the dollar’s rally isn’t over yet, and there is more … “Dollar Index Lower After Touching 100”

Positive Employment Data Leads to Massive Gains for AUD

The Australian dollar climbed today, rising 1 percent against its US peer, after a report showed robust growth of Australia’s employment and an unexpected drop of the unemployment rate. Australian employment grew by 15,600 in February from the previous month, in line with expectations. The unemployment rate ticked down a little to 6.3 percent, and this was unexpected. The data made the Aussie stronger, especially against the US dollar that weakened ahead of US … “Positive Employment Data Leads to Massive Gains for AUD”

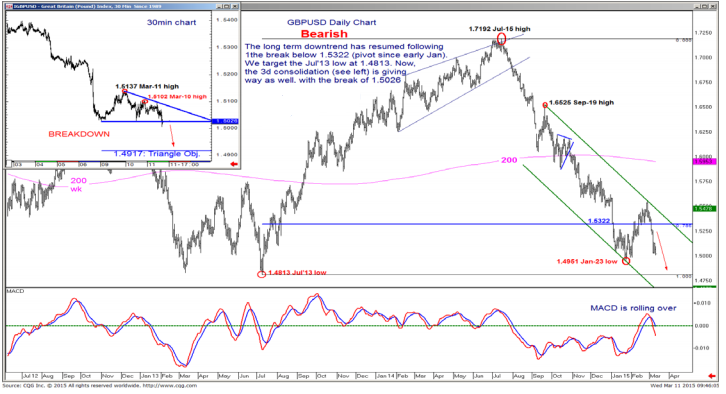

GBP/USD Breakout: Levels & Targets – BofA, Goldman

GBP/USD lost the very round 1.50 but is certainly giving a fight and battling over this level. What’s next for cable? The team at Bank of America Merrill Lynch examine the technical levels for pound/dollar. Here is their view, courtesy of eFXnews: With the USD bull trend intact, attention turns to the ongoing breakout in GBP/USD. … “GBP/USD Breakout: Levels & Targets – BofA, Goldman”

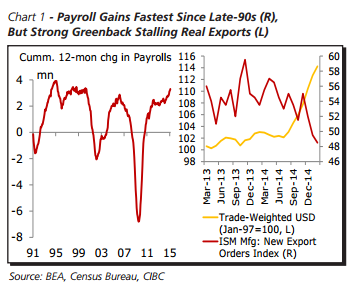

The Last Leg Of USD Strength Set To Start Next

The US dollar enjoyed yet another strong surge, sweeping also currencies that had showed resilience beforehand. Is it over? Not so fast. The team at CIBC explains the motives and the timing for the next leg up in the greenback, that may be the last for this cycle. Here is their view, courtesy of eFXnews: All good … “The Last Leg Of USD Strength Set To Start Next”

Euro Dives to New Multi-Year Lows

The euro plunged to new multi-year lows against its major rivals as negative factors persisted, driving the shared 19-nation currency down. This is not necessary bad for the eurozone as the weaker currency helps European exporters. There are plenty of reasons for the euro to go down. One of them is the quantitative easing program that the European Central Bank has started on Monday. Of course, Greece remains a sore topic. And on top of that, … “Euro Dives to New Multi-Year Lows”