After another strong jobs report from the US expectations have risen for a removal of forward guidance: no more patience from the Fed regarding rates. But how can that affect the dollar? Robin Brooks, George Cole and Michael Cahill analyze, and see room for more: Here is their view, courtesy of eFXnews: “One reason we adopted … “How Much Of A USD Strength Into Upcoming FOMC? – Goldman”

Month: March 2015

Aussie Gains Despite Data from China

The Australian dollar gained today even though economic data from China, the biggest trading partner of Australia, was not particularly supportive for the currency. China reported that its trade surplus grew in February. While positive economic data from the Asian nation is usually good for the Australian currency, the improvement of the balance was a result not only of higher exports but also falling imports, and it is bad news … “Aussie Gains Despite Data from China”

USD/JPY: Trading the JOLTS Job Openings

JOLTS Job Openings measures the number of employment openings each month, excluding the farm industry. A reading which is higher than the market forecast is bullish for the dollar. Update: US JOLTs 4998K – just below predictions Here are the details and 5 possible outcomes for USD/JPYUSD/JPY Published on Tuesday at 14:00 GMT. Indicator Background Job creation is … “USD/JPY: Trading the JOLTS Job Openings”

Dollar Forecast for Week Before Fed Meeting

The US dollar ended the last week on a positive note. Can the US currency maintain its bullish momentum or a pause in the rally should be expected? There are arguments for both possibilities. On one hand, the previous weekâs gains resulted in a clear-cut uptrend. On the other, the rally might be considered a bit excessive after the Dollar Index reached the 11-year high. If the latter sentiment takes hold of the market then some form of correction … “Dollar Forecast for Week Before Fed Meeting”

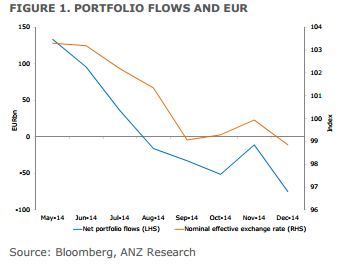

EUR/USD: 1.05 Next Target En-Route To Parity; Downtrend Firmly

EUR/USD crashed quite sharply following the one two punch from Draghi and the NFP, closing at 1.0846. This may not be the end. Brian Martin & Dylan Eades of ANZ foresee the next levels down the road, and explain with a chart: Here is their view, courtesy of eFXnews: “Price action has confirmed that the euro is … “EUR/USD: 1.05 Next Target En-Route To Parity; Downtrend Firmly”

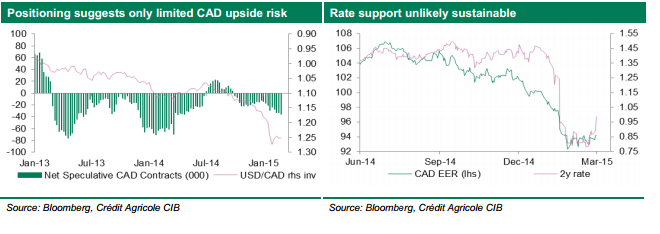

CAD: Staying Short; NZD: Sell-Off An Over-Reaction – Credit

All commodity currencies were crushed under the strength of the greenback following the excellent NFP. But not all commodities are equal. The team at Credit Agricole explains the different situations in both CAD and NZD: Here is their view, courtesy of eFXnews: Both the Bank of Canada’s less dovish monetary policy stance and stabilising commodity price developments … “CAD: Staying Short; NZD: Sell-Off An Over-Reaction – Credit”

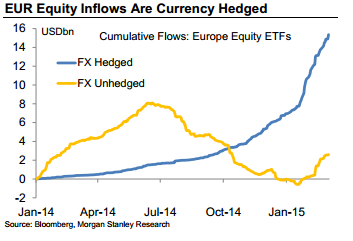

Rally in EUR? Here is why it is difficult –

We have already seen how good euro-zone data does NOT help the euro, and the spectacular crash following the US NFP. Why does this happen to the common currency? The team at Morgan Stanley explains: Here is their view, courtesy of eFXnews: Over the past couple of weeks, economic data in Europe have improved noticeably, led … “Rally in EUR? Here is why it is difficult –”

US NFP & European QE Make Week Stellar for Dollar

The US dollar had an amazing trading week, reaching the highest level in more than a decade against the euro, thanks to positive economic data from the United States and quantitative easing in Europe. The monetary policy announcement of the European Central Bank was positive for the dollar, driving the US currency to a new multi-year low against the euro. While the ECB left its policy unchanged, the central bank announced that a start of quantitative easing program … “US NFP & European QE Make Week Stellar for Dollar”

Canadian Dollar Drops vs. Greenback, Fares Better vs. Other Currencies

The Canadian dollar dropped against its US counterpart after the release of non-farm payrolls. The loonie fared better against other currencies, rising against the euro and trading sideways versus the Japanese yen, even though Canada’s economic indicators were not particularly good. The US dollar rallied against other currencies after the NFP, making it unsurprising that the Canadian dollar fell against it. The rally of the greenback had also … “Canadian Dollar Drops vs. Greenback, Fares Better vs. Other Currencies”

NFP Surprise Positively, Early Rate Hike Is Probable

One of the most important events this week was today’s release of US non-farm payrolls. While analysts expected robust employment growth, the actual report turned out to be even better than was expected, spurring talks about an early interest rate hike from the Federal Reserve. The US dollar rallied against its most-traded peers as a result. According to the payrolls, US employers added as much as 295,000 jobs in February … “NFP Surprise Positively, Early Rate Hike Is Probable”