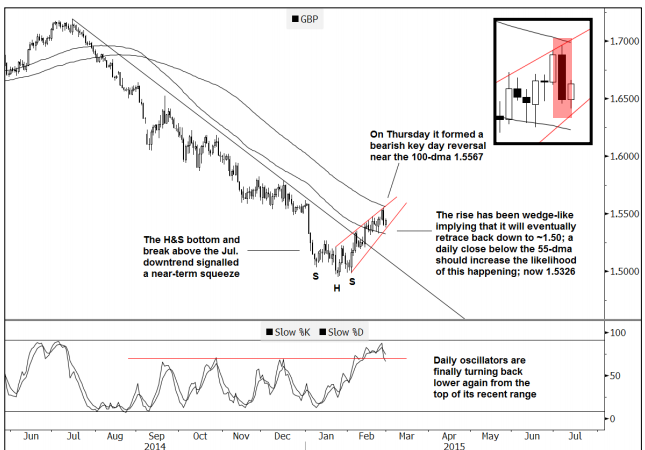

Cable advanced quite nicely but hit a high and began retreating, mostly due to the strength of the pound. What’s next for cable? The team at Goldman Sachs provides a technical analysis for GBP/USD: Here is their view, courtesy of eFXnews: GBP/USD had a false break lower into the end of last week but ultimately still … “GBP/USD: False Break But Still Wedge-Like – Goldman Sachs”

Month: March 2015

Aussie Trades Higher After RBA Refrains from Action

The Australian dollar was trading above the opening level today after the Reserve Bank of Australia surprised the market by refusing to cut its main interest rate. Coupled with good macroeconomic reports, fundamentals looked very positive for the Aussie. The RBA left its key cash rate at 2.25 percent at today’s policy meeting while the majority of market analysts expected a decrease by 25 basis points. The central bank explained its decision: … “Aussie Trades Higher After RBA Refrains from Action”

Growing Canadian Economy Makes CAD Stronger

The Canadian dollar climbed today with the help of an economic report that showed faster-than-expected growth of Canada’s economy at the end of the last year. The positive surprise made the currency gain against other majors. Canada’s gross domestic product expanded by 0.3 percent in December from the previous month, exceeding market expectations. GDP grew by 0.6 percent in the last quarter of 2014 from the previous three months. Not all the reports were positive … “Growing Canadian Economy Makes CAD Stronger”

Euro Loses Ground to Majors

The embattled euro is losing ground again today, thanks to the latest news from other countries that indicate how far the 19-nation currency still has left to go. The continuing Greek saga isn’t helping matters, either. Yesterday, the euro showed some fight, gaining a bit of ground against its major counterparts. Today, though, that fight is gone. After yesterday’s manufacturing data out of the United States, … “Euro Loses Ground to Majors”

Why euro-zone positive surprises will NOT lift EUR/USD yet

Indicator after indicator, the data flowing out of the euro-zone continues beating expectations. After so many months of gloom, the economic situation could have reached a point where it just couldn’t get worse. And, the weaker euro seen in recent months also played a role and is beginning to being felt. Is this enough to … “Why euro-zone positive surprises will NOT lift EUR/USD yet”

AUD/USD: Trading the Australian GDP Mar 2015

Australian GDP is the primary gauge of the production and growth of the economy. It is considered by analysts as one the most important indicators of economic activity. A reading which is higher than expected is bullish for the Australian dollar. Here are all the details, and 5 possible outcomes for AUD/USD. Published on Wednesday at … “AUD/USD: Trading the Australian GDP Mar 2015”

Australian Dollar: Up, Down or Indecision?

A brief overview of AUD/USD: January & February of 2015 has seen the Australian dollar touch lows of 0.7625 against the US Dollar which it had last breached way back in May of 2009. Past two months has seen a range bound movement of approximately 400 pips between 0 8030 – 0.7630. Price action in … “Australian Dollar: Up, Down or Indecision?”

Positive Trade Data Doesn’t Support NZ Dollar

The New Zealand dollar dropped today even though macroeconomic data released from the South Pacific country over the weekend was better than economists had anticipated. Statistic New Zealand reported that the Overseas Trade Index dropped 1.9 percent in the fourth quarter of 2014 from the previous three months. While the reading itself was not particularly good, it was better than the forecast drop by 2.9 percent. … “Positive Trade Data Doesn’t Support NZ Dollar”

Aussie Weak Ahead of RBA Decision

The Australian dollar was trading below the opening level today as traders are waiting for tomorrow’s monetary policy decision from the Reserve Bank of Australia. Prospects for an interest rate cut hurt the attractiveness of the Aussie. The RBA will conduct its policy meeting during the early Tuesday’s session, and many analysts believe that the central bank will reduce its main interest rate by 25 basis points to a new historical low of 2 … “Aussie Weak Ahead of RBA Decision”

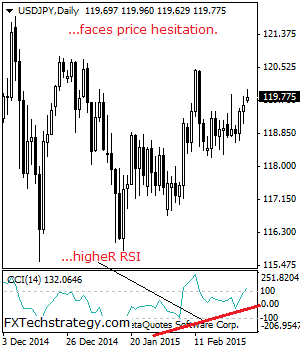

USDJPY: Vulnerable Below The 120.47 Level

USDJPY: Despite the pair’s marginal higher close the past week, it still faces bear risk while holding below the 120.47 level. On the downside, support comes in at the 118.62 level where a break will target the 118.00 level. Below here if seen will aim at the 117.00 level followed by the 116.00 and then … “USDJPY: Vulnerable Below The 120.47 Level”