Japan based GMO CLICK Group goes global and launches global operations with its proprietary platform and FCA regulation. Here is more about the move, using a rare single letter domain: London UK, March 2nd 2015 – The world’s largest retail forex provider by volume’s London office launched its in-house developed trading platform today. GMO-Z.com Trade UK … “Z.com starts operating with FCA regulation, own platform”

Month: March 2015

Japanese Yen Mostly Lower After Chinese Rate Cut Announcement

Japanese yen is mostly lower today, weakening as the Chinese rate cut announced recently causes Forex traders to consider what’s next. The yen is weakening again, thanks in large part to the interest rate news out of China. Officials have announced a rate cut, and there is a meeting to create China’s budget and release a new economic growth forecast coming up. There is a great deal of speculation about what this … “Japanese Yen Mostly Lower After Chinese Rate Cut Announcement”

UK Pound Struggles at the Beginning of a Data-Heavy Week

UK pound is struggling today as a new week and a new month get underway. It’s expected to be a data-heavy week, and sterling is expected to be impacted. Right now, the UK pound is lower against its major counterparts. Sterling is starting out the week lower, losing ground to its major counterparts. Concerns that the British economic recovery is flagging are weighing on the UK pound. Against the US … “UK Pound Struggles at the Beginning of a Data-Heavy Week”

USD/CAD: Trading the Canadian GDP Mar 2015

Canadian GDP is a measurement of the production and growth of the economy. Analysts consider GDP one the most important indicators of economic activity and a reading which is better than the market forecast is bullish for the Canadian dollar. Update: Canadian GDP rises 0.3% – USD/CAD falls Here are all the details, and 5 possible outcomes … “USD/CAD: Trading the Canadian GDP Mar 2015”

RBA set to move on rates tomorrow

The pressure is on for the Australian dollar tomorrow as analysts are dived over whether the Reserve Bank of Australia will cut interest rates again following on from the rate cut in February. The market is now pricing in around a 55% chance that he central bank will reduce rates tomorrow, up from around 38% … “RBA set to move on rates tomorrow”

Forex Crunch Key Metrics February 2015

The second month of the year was the second best month ever for Forex Crunch and a 65% y/y rise in page views, but in comparison to the amazing levels seen in January (featuring the SNBomb among other events), it represents a big fall. What will the ides of March carry? Hopefully a resumption of elevated volatility. … “Forex Crunch Key Metrics February 2015”

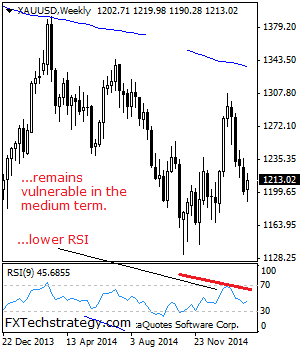

GOLD: Risk Remains Lower Despite Recovery Attempts

GOLD: Although a marginal higher close occurred the past week, GOLD continues to retain its broader downside pressure. On the upside, resistance resides at the 1,219.98 level where a break will aim at the 1,230.00 level, its key psycho level. A violation of here will turn attention to the 1,250.00 level followed by the 1,180.00 … “GOLD: Risk Remains Lower Despite Recovery Attempts”

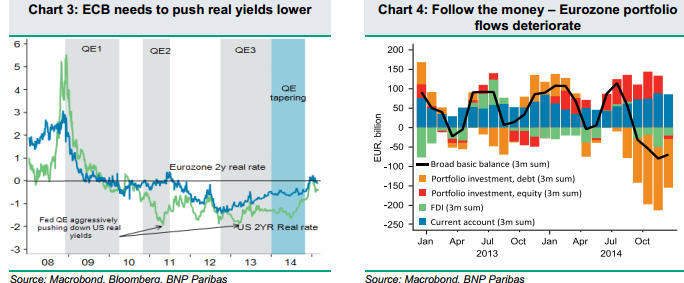

ECB QE: Go With The Flow & Sell The EUR – BNPP

The ECB is about to commence with its massive QE program. Is it already priced in or has the euro more room to run down? Vassili Serebriakov from BNP Paribas explains why the pair could further fall: Here is their view, courtesy of eFXnews: “As the ECB prepares to launch its full-scale QE programme next … “ECB QE: Go With The Flow & Sell The EUR – BNPP”