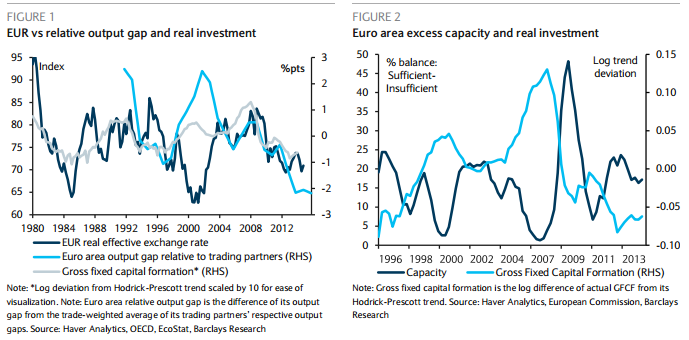

EUR/USD seemed to have found a range between 1.05 and 1.10. But, can it maintain it? The team at Barclays sees ambitious low targets for euro/dollar and explain the drivers. Here is their view, courtesy of eFXnews: How much lower can the EUR fall? “By our soundings, a lot”, answers Barclays in its quarterly note to … “EUR/USD to parity by Q3 and to 0.95 by end”

Month: March 2015

Dollar Fights Downside Pressure

The US dollar was in the corrective mode lately following the earlier impressive rally. Still, the currency was trying to fight back over the past trading week with some success as its losses against the euro and the Japanese yen were not as big as during the preceding week. In fact by the weekend, the greenback managed to log small gains against many currencies, including the Great Britain pound. The dollar suffered mostly from speculations that … “Dollar Fights Downside Pressure”

Euro Ends Session Almost Flat After Volatile Trading

The euro ended Friday virtually flat against the US dollar and the Japanese yen while against the Great Britain pound the currency closed below the opening level but trimmed most of the daily loss. Friday’s trading was rather volatile as currencies had trouble establishing a clear-cut trend. As a nice example of that, the euro was falling in the first half of the trading session, bounced later but retreated closer to the opening level afterwards. The reason … “Euro Ends Session Almost Flat After Volatile Trading”

Dollar Falls, Heads to Weekly Losses

The US dollar fell today following disappointing macroeconomic reports from the United States. The losses were very limited but the greenback was still set to be one of the weakest currencies on the Forex market over the past week. The final revision of US gross domestic product confirmed that the US economic growth slowed in the fourth quarter of 2014. The Survey of Consumers performed by the University of Michigan showed that the consumer sentiment worsened in March … “Dollar Falls, Heads to Weekly Losses”

Canadian dollar: What’s next? 4 Issues from Nomura and

The Canadian dollar managed to improve its position recently, with USD/CAD retreating from the highs that got it close to 1.30. The rising oil prices following the crisis in Yemen helped, but did not last too long. So what’s next for the loonie? Here are views from Nomura and Morgan Stanley: Here is their view, courtesy … “Canadian dollar: What’s next? 4 Issues from Nomura and”

Aussie Mostly Lower as Gold Prices Drop

Australian dollar is mostly lower today, falling against its major counterparts, as risk appetite flees and gold prices drop. Aussie isn’t expected to improve much in the coming weeks, either. There is a lot weighing on the Aussie right now. Aussie is losing ground fast today and is lower against most of its counterparts. One of the few currencies that is losing ground to the Aussie is the euro, which is … “Aussie Mostly Lower as Gold Prices Drop”

Rising chances of BOJ action in April following weak

Japan reported its inflation numbers, and they were disappointing. The numbers are still skewed by the sales tax hike that sent the country into recession in April 2014, but if you exclude them, it is impossible to say that the Bank of Japan is nearing its 2% inflation goal. With USD/JPY basically stuck in a range around … “Rising chances of BOJ action in April following weak”

Resell EUR/USD to 1.04 – BNPP

The US dollar is on the rise again and the euro begins to feel the heat. Is there more room to go? The team at BNP Paribas certainly thinks so and sets a low target: Here is their view, courtesy of eFXnews: The USD has relatively retreated in the aftermath of the 18 March FOMC statement. … “Resell EUR/USD to 1.04 – BNPP”

Euro Loses Weekly Gains

The euro sank today, losing most of its weekly gains versus the US dollar and erasing the weekly rally against the Japanese yen completely. The currency fell even though macroeconomic news from Germany was positive. The GfK German Consumer Climate rose from 9.7 in March to 10.0 in April while economists have though that the gauge would stay little changed. The Ifo Business Climate Index for Germany rose from … “Euro Loses Weekly Gains”

Dollar Attempts Recovery

The US dollar is attempting to stage a recovery during the Thursday’s trading session. For a change, news from the United States was positive, allowing the currency to regain some of its strength. The dollar has been subdued recently and it looked like the currency is going to extend its losses today. Yet several positive events helped the currency to bounce against major rivals. On the data front, the unexpected drop of unemployment claims last … “Dollar Attempts Recovery”