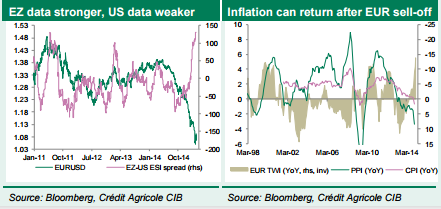

EUR/USD has fallen off the highs thanks to the dollar’s weakness (here are 3 reasons). However, it is still trading high – not too far from 1.10. The team at Credit Agricole examines whether euro/dollar is at a turning point. Here is their view, courtesy of eFXnews: The Eurozone economic outlook is improving and portfolio … “EUR/USD: Is This A Turning Point? – Credit Agricole”

Month: March 2015

NZ Dollar Endangered by US Data & Market Sentiment

The New Zealand dollar attempted to rally against its US counterpart and to trim its earlier losses versus the Japanese yen. The currency will likely have problems in achieving those goals due the unexpectedly good unemployment data from the United States and the risk aversion caused by geopolitical tensions in the Middle East. The kiwi’s performance was very similar to that of the UK pound as the currency was rising against the US dollar and attempted to bounce … “NZ Dollar Endangered by US Data & Market Sentiment”

Pound Rallies vs. Dollar, Unable to Beat Other Currencies

The Great Britain pound rallied against the US dollar today as UK retail sales exceeded analysts’ expectations. The sterling’s performance against other currencies was not so good, and Britain’s currency touched the lowest level in almost two months against the Japanese yen. The Office for National Statistics reported that retail sales were up 0.7 percent in February from the previous month. The increase was bigger than the forecast 0.4 … “Pound Rallies vs. Dollar, Unable to Beat Other Currencies”

Loonie Surges Along With Oil

Canadian dollar is heading higher today, thanks to a surge in oil prices. Crude is on the rise after the Saudi strikes in Yemen, and that is helping the loonie against its major counterparts. Loonie is heading higher against most of the major currencies today as oil prices surge. Saudi Arabian strikes into an unstable Yemen are threatening oil supply from the Middle East, and that has finally arrested the slide … “Loonie Surges Along With Oil”

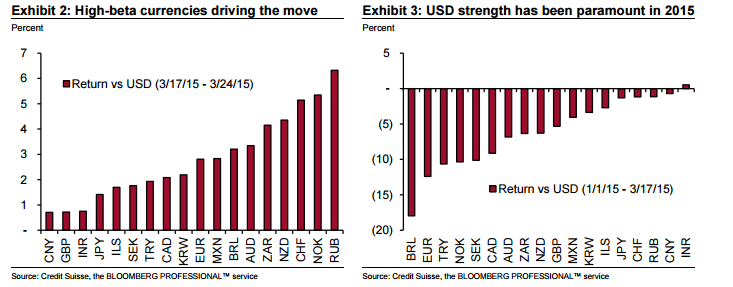

An Uneven USD Pullback; What’s Next? – Credit Suisse

The US dollar is no longer sweeping the board, and actually losing out to some currencies. The changes are far from being even. Credit Suisse analyzes the situation and explains what’s next for the greenback: Here is their view, courtesy of eFXnews: Last week’s FOMC meeting decision saw the “patience” language removed but at the … “An Uneven USD Pullback; What’s Next? – Credit Suisse”

GBP/USD: Trading the UK Retail Sales March 2015

British Retail Sales is considered one of the most important economic indicators. A reading that is higher than the market forecast is bullish for the British pound. Update: UK retail sales + 0.7% – GBP/USD higher Here are all the details, and 5 possible outcomes for GBP/USD. Published on Thursday at 9:30 GMT. Indicator Background Retail Sales is the primary gauge of … “GBP/USD: Trading the UK Retail Sales March 2015”

Aussie Flat vs. Greenback, Retains Losses vs. Other Rivals

The Australian dollar dipped today against its major rivals. While the currency was staying close to the opening level against the US dollar, it retained losses versus other currencies, including the euro. Some analysts attributed the Aussie’s weakness to the strength of the US currency. But the greenback fell after unfavorable economic data from the United States, yet the Australian dollar remained soft against other currencies. The Aussie, being a commodity-related … “Aussie Flat vs. Greenback, Retains Losses vs. Other Rivals”

NZ Dollar Bounces During European Session

The New Zealand dollar was falling during the Asian trading session as the nation’s trade surplus did not match expectations, being much smaller than economists have hoped for. Yet the currency bounced during the European session and is hanging close to the opening level now. The New Zealand trade balance demonstrated a surplus of NZ$50 million in February, up from NZ$33 million in January. Still, the value was far below … “NZ Dollar Bounces During European Session”

FXCM sells Japanese unit for $62 million – part of

FXCM has announced the sale of its Japanese unit FXCM Japan to Rakuten Securities for $62 million. This is part of the US broker’s consolidation and business change. The firm was hit hard by the SNBomb: the Swiss National Bank’s decision to remove the 1.20 floor under EUR/CHF, back on January 15th. The decision had a material … “FXCM sells Japanese unit for $62 million – part of”

US Dollar Falls After Earlier Rally

US dollar is lower right now, following a rally earlier. Greenback had seen some success after the US inflation report, but now is pulling back. Dollar saw a rally earlier, following an inflation report that had many forex traders speculating that a Federal Reserve rate hike might come sooner after all. However, the rally was short-lived and there are concerns again about … “US Dollar Falls After Earlier Rally”