The US dollar weakness helped GOLD to some extent recently, as it gained and traded above the $1190 level. However, it was seen struggling around the $1195 level where sellers managed to contain the upside. However, there are some support levels on the downside as well, which area likely to act as a catalyst for … “GOLD Likely To Trade Higher Moving Ahead”

Month: March 2015

Swiss Franc Strongest on FX Market During Tuesday’s Trading

The Swiss franc was among the strongest currencies on the Forex market today, extending its rally that the currency has started earlier this month. The Swissie found demand among traders after other traditional safe currencies, like the dollar and the yen, have lost steam. The franc made a huge leap after the Swiss National Bank unpegged the currency from the euro, but the Swissie was falling steadily after that. Yet … “Swiss Franc Strongest on FX Market During Tuesday’s Trading”

Euro Retreats After Positive Reports from the United States

Initially, it looked like the euro is going to extend its gains through the Tuesday’s trading session with the help of macroeconomic data from Europe. Yet the currency retreated after the release of US reports that were good as well. The shared 19-nation currency was rising for the first part of the session as European economic indicators were mostly good. The currency attempted to hold ground even the first economic release from the USA … “Euro Retreats After Positive Reports from the United States”

Australian Dollar Jumps After Trading Flat amid Mixed Fundamentals

The Australian dollar was under pressure during the current trading session after a private report showed that China’s manufacturing was deteriorating this month. Yet the currency did not move far initially as other data from China was not bad and the domestic indicators were supportive as well. The Aussie made a sharp jump just recently. The HSBC Flash China Manufacturing Purchasing Managersâ Index dropped from 50.7 … “Australian Dollar Jumps After Trading Flat amid Mixed Fundamentals”

No Inflation in Great Britain, Pound Slides

The Great Britain pound dropped after an official report showed that consumer prices in the United Kingdom were unchanged from the previous year. The data weighed on the currency, sending it into the second consecutive daily decline. The Office for National Statistics reported that the Consumer Price Index showed no change in February from the same period a year ago. The report frustrated economists who were counting on at least some growth even … “No Inflation in Great Britain, Pound Slides”

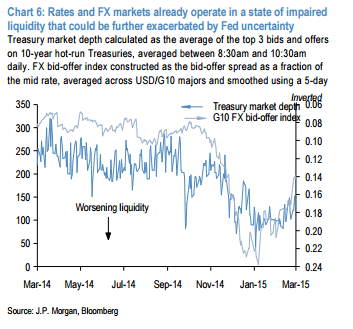

Greater Uncertainty Now Infects The Dollar’s Path – JP

The US dollar reversed its gains following the dovish statement from the Fed. Was this an overreaction an opportunity to sell EUR/USD as some suspect? Or perhaps there is a real change? According to the team at JP Morgan, this now infects the dollar’s path. Here is their view, courtesy of eFXnews: “While the needle … “Greater Uncertainty Now Infects The Dollar’s Path – JP”

Higher Oil Helps Canadian Dollar

Canadian dollar is getting some help today from higher oil prices. Dollar weakness has set in, and oil prices are moving higher, providing the loonie with a bit of an advantage. Canadian dollar has struggled quite a bit recently, thanks largely to floundering oil prices. Oil has been lower, thanks to increased supply, and that has weighed on the loonie, which is connected to oil prices. Now, … “Higher Oil Helps Canadian Dollar”

US Dollar Falls as Rate Hike is Pushed Back

One of the things supporting the US dollar in recent months has been the expectation that a rate hike from the Federal Reserve is just around the corner. With the rate hike likely being pushed back, and with commodities gaining ground, the US dollar is dropping. Greenback is mostly lower today against its major counterparts as Forex traders consider that the Federal Reserve rate hike may not be … “US Dollar Falls as Rate Hike is Pushed Back”

EUR/USD: Trading the German IFO Mar 2015

German Ifo Business Climate is a monthly composite index of about 7,000 businesses, which are surveyed about current business conditions and their expectations concerning economic performance over the next six months. A reading which is higher than the estimate is bullish for the euro. Here are all the details, and 5 possible outcomes for EUR/USD. … “EUR/USD: Trading the German IFO Mar 2015”

3 Reasons Why Selling EUR/USD Still Attractive – RBS

EUR/USD has gained quite a lot since it hit the lows of 1.0460 and even made a flash move above 1.10. However, not all are convinced that the move is real. The team at RBS lists 3 reason to continue selling EUR/USD. Here is their view, courtesy of eFXnews: Selling EUR/USD is still among the favorite … “3 Reasons Why Selling EUR/USD Still Attractive – RBS”