The euro enjoyed a decent rally last week with the unexpected help from the US Federal Reserve. Will the currency be able to maintain its upward momentum after the initial shock from the Fedâs statement fades? The major driving force behind the euroâs rally was the weakness of the dollar following the Fedâs announcement. At the start of the current trading week, that factor continued to influence the Forex market. Yet the statement was not dovish … “What Future Holds for Euro After Fed-Inspired Rally?”

Month: March 2015

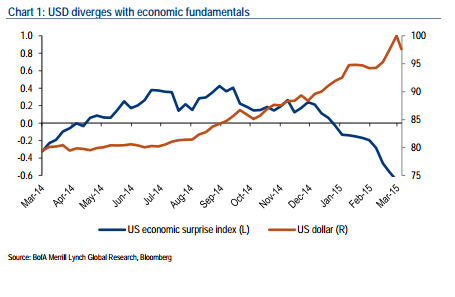

The Dollar Dilemma – BofA Merrill

The dollar has taken a turn down after strong weeks of rises. What’s next for the greenback? Emanuella Enenajor of Bank of America Merrill Lynch analyzes the fundamentals: Here is their view, courtesy of eFXnews: “In mid-2014, upside surprises in US economic data triggered the start of a persistent appreciation in the dollar. We have argued that … “The Dollar Dilemma – BofA Merrill”

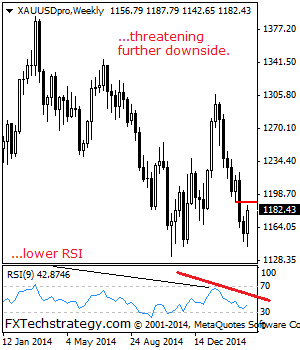

GOLD: Biased To The Upside On Corrective Recovery

GOLD: With GOLD halting its weakness and triggering a recovery the past week, further strength is expected. On the downside, support comes in at the 1,175.25 level where a break will aim at the 1,160.00 level. Below here if seen could trigger further downside towards the 1,140.00 level where a break will aim at the … “GOLD: Biased To The Upside On Corrective Recovery”

NZ Dollar Joins Rally Against US Dollar

Like its Australian counterpart, the New Zealand dollar extended its rally today at the expense of the US dollar. The kiwi also had support from domestic economic data released over the weekend. The New Zealand currency had a very similar performance to that of the Australian dollar, opening sharply higher and continuing to move up. High-beta currencies rallied against safer ones, especially the US dollar, after the Federal Reserve made a statement … “NZ Dollar Joins Rally Against US Dollar”

Australian Dollar Continues to Move Higher

The Australian dollar continued to move higher during the current trading session as the latest policy statement from the Federal Reserve hurt the US dollar, allowing other currencies to carve out gains. The Fed statement had a big impact on the Forex market, and its influence still persists. The event had not just a direct impact on the FX market, weakening the greenback, but also an indirect one by bolstering prices for raw materials. The latter supported … “Australian Dollar Continues to Move Higher”

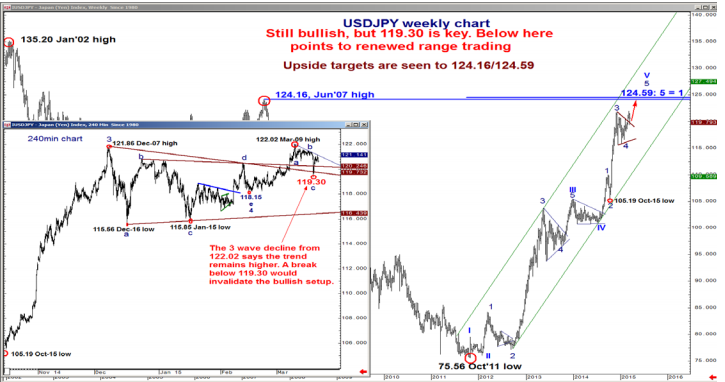

Stay Bullish USD/JPY; Don’t Fight The Tape In EUR/GBP –

Dollar/yen has been on the back foot due to the weakness of the US dollar and the Fed’s more dovish tone regarding rate hikes. Nevertheless, the team at Bank of America Merrill Lynch see the bullish trend intact. They also see interesting patterns in EUR/GBP: Here is their view, courtesy of eFXnews: USD/JPY decline from … “Stay Bullish USD/JPY; Don’t Fight The Tape In EUR/GBP –”

Deflation Fears Hold UK Pound Back

Worries about deflation are holding the UK pound back today. Sterling is mostly lower against its major counterparts, struggling as Forex traders process the weak data already shared and worry about the next data releases. Deflation concerns are on the rise, thanks in large part to the latest inflation figures, released last last week. Price growth slowed to 0.1 per cent in February, a drop from the 0.3 per cent … “Deflation Fears Hold UK Pound Back”

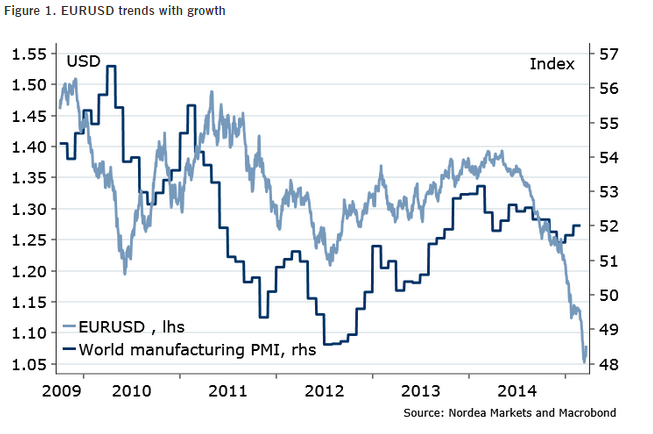

EUR/USD: Turning Points – Nordea

EUR/USD managed to bounce back, but it isn’t exactly stable right now: volatility is rising and the pair is looking for a new direction. The team at Nordea examine the turning points for the pair: Here is their view, courtesy of eFXnews: Blame the US economic data disappointments for the recent strength in USD and lower … “EUR/USD: Turning Points – Nordea”

Euro Adds More Gains

Euro is adding more gains today, heading higher on the Forex market as eurozone officials continue to insist that Greece will remain. Additionally, an improving economic picture is helping the 19-nation currency. Euro is mostly higher today, gaining ground as signs point to economic recovery. Last week, German economic data was better than expected, and ECB President Mario Draghi continues to show optimism. He addresses … “Euro Adds More Gains”

AUD/USD: Trading the Chinese HSBC Flash Manufacturing PMI

Chinese Flash Manufacturing PMI (Purchasing Managers’ Index) is based on a survey of purchasing managers in the manufacturing sector. Respondents are surveyed for their view of the economy and business conditions in China. A reading which is higher than the market forecast is bullish for the Australian dollar. Here are all the details, and 5 possible … “AUD/USD: Trading the Chinese HSBC Flash Manufacturing PMI”