The Fed said its word and stirred markets. But what exactly was in there? We dissect the carefully crafted words from the world’s most important central banks, the underlying state of the US economy, market reactions now and looking forward regarding currencies, commodities, stocks and bonds, and lots more. Welcome to a new episode of Market Movers, presented by … “The Fed and the road ahead – all you need”

Month: March 2015

FXCM UK new negative balance policy waives first $50,000

The UK subsidary of FXCM, one of the firms that suffered a blow in the fallout of the SNBomb, has announced an upcoming updated to its negative balance policy. Here is a list of 10 brokers not fully waiving negative balances. And from here on, please find the press release by FXCM: LONDON, March 20, 2015 (GLOBE NEWSWIRE) … “FXCM UK new negative balance policy waives first $50,000”

GBPJPY: Looks To Extend Weakness

GBPJPY: With the cross declining strongly on Thursday, it faces further weakness. On the downside, support comes in at the 177.50 level where a violation will aim at the 177.00 level. A break below here will target the 176.00 level followed by the 175.00 level. Further down, support lies at the 174.00 level. Conversely, on … “GBPJPY: Looks To Extend Weakness”

The Fed is more dovish, but USD is still king

The dollar got a big blow from the more dovish tone heard from Yellen and her colleagues, with the dot chart standing out as a sign that rate hikes will be delayed, or at least sporadic rather than systematic. But in the morning after, other currencies had a serious hangover. Why? They cannot really stand on their … “The Fed is more dovish, but USD is still king”

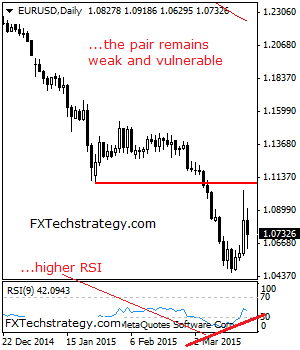

EURUSD: Loses Rally Gains, Weakens

EURUSD: With EUR seen taking back most of its rally gains on Thursday, further weakness is now envisaged. Resistance is seen at 1.0750 level with a cut through here opening the door for more downside towards the 1.0800 level. Further up, resistance lies at the 1.0850 level where a break will expose the 1.0900 level. … “EURUSD: Loses Rally Gains, Weakens”

Performance of Swiss Franc Mixed After SNB Policy Meeting

The Swiss National Bank kept its monetary policy unchanged at today’s meeting, leaving interest rates in the negative territory. The Swiss franc fell against the US dollar after the announcement but gained on the euro and was little changed against the Japanese yen. The SNB kept borrowing costs unchanged today, mentioning that negative interest rates make the franc less attractive as an investment option. Still, the central bank said in the statement: Overall, … “Performance of Swiss Franc Mixed After SNB Policy Meeting”

Aussie Falls Back After Earlier Leap

The Australian dollar leaped higher earlier on the news that the Federal Reserve was revising its economic forecast. Now, after a jump, the Aussie is down against the dollar and the pound, although it is still higher against the euro. Aussie got a boost after the Federal Reserve released its statement yesterday. Indeed, a number of currencies surged higher against the greenback after the Fed announcement. Things have settled down again for the Australian … “Aussie Falls Back After Earlier Leap”

Japanese Yen Gains Ground After Export Report

Japanese yen is gaining ground today, heading higher against European currencies following the latest export report, and ahead of the release of the Bank of Japan minutes from the latest meeting. Right now, Japan is still trying to navigate its economy and figure out what to do next. A recent export report from Japan indicates that exports rose for another month, but that volumes are falling. The policy that Japan … “Japanese Yen Gains Ground After Export Report”

Fed’s Patient In Deed, If Not Word; USD On Their

The Federal Reserve removed the “patience” wording but more than balanced this with dovish wording, The Federal Reserve removed the “patience” wording. And how exactly does the Fed see the greenback? The team at Bank of America Merrill Lynch explains: Here is their view, courtesy of eFXnews: The following is Bank of America Merrill Lynch’s reaction … “Fed’s Patient In Deed, If Not Word; USD On Their”

Rally of Euro Doesn’t Convince Analysts

The euro rallied together with other currencies today after the Federal Reserve trimmed its economic forecasts, leading to speculations about a delay for the planned monetary tightening. Still, analysts are not convinced by the rally of the euro and think that the currency should retreat very soon. While the shared 19-nation currency rallied on the back of the dollar’s weakness, the internal European problems should support a bearish bias of the currency. With struggling economies of the European … “Rally of Euro Doesn’t Convince Analysts”