As was expected, the Federal Reserve dropped the phrase ‘patience’ from its statement, and that should have been a bullish event for the US dollar. Yet in reality the currency tumbled after the announcement. What are possible reasons for such behavior? One of the possible reasons for the drop is that the event has been priced in, and now traders are just taking profit. Yet there are other reasons as well, like the downward … “Dollar Tumbles After Fed Drops Phrase ‘Patience’”

Month: March 2015

4 reasons why the dollar is down on the Fed

The Fed said its word: removed patience, but also said a lot of other things. The USD is selling off heavily after a statement that saw the removal of forward guidance: the move that paves a rate hike. Why? Here are 4 quick reasons: Confidence needed on inflation: Beforehand they seemed more confident. Yellen still sees oil … “4 reasons why the dollar is down on the Fed”

Loonie Continues Its Fall Against the Greenback

Canadian dollar is continuing its fall against the greenback today, heading lower than it’s been in years as Forex traders look forward to today’s Federal Reserve announcement. It’s also not helping matters that oil prices continue to fall. Loonie is trading mixed today. However, against its most important currency counterpart, the greenback, the loonie continues to drop. Even though the Canadian dollar is higher … “Loonie Continues Its Fall Against the Greenback”

NZ Dollar Pares Losses But Remains Vulnerable

The New Zealand dollar pared its earlier losses during the Wednesday’s trading session but remains vulnerable as fundamentals, both domestic and overseas, are negative for the currency. New Zealand’s current account balance deficit (seasonally adjusted) widened by NZ$175 million to NZ$2.6 billion in the December 2014 quarter from the previous three months. The Global Dairy Trade Price Index dropped 8.8 percent since the beginning of March. The domestic data, coupled … “NZ Dollar Pares Losses But Remains Vulnerable”

US Dollar Mixed; Dollar Index Lower

The US dollar index is lower today, while the US dollar trades mixed against its major counterparts. In a lot of ways, the dollar is “wait and see” mode as Forex traders and others await the latest Federal Reserve decision and statement. While no one expects the Federal Reserve to announce a rate hike immediately, there is still a lot of curiosity about the announcement expected later today. As a result of speculation, the US dollar … “US Dollar Mixed; Dollar Index Lower”

Sterling Loses Support from Interest Rate Hike Expectations

Today’s employment data from the United Kingdom and the minutes of the latest Bank of England’s policy meeting suggested that there likely will not be an interest rate hike in the near future. Hopes for monetary tightening were a key component for the strength of the Great Britain pound, and the currency has been weakening as chances for an early rate hike were waning. The employment report released during the current trading session was mostly disappointing with … “Sterling Loses Support from Interest Rate Hike Expectations”

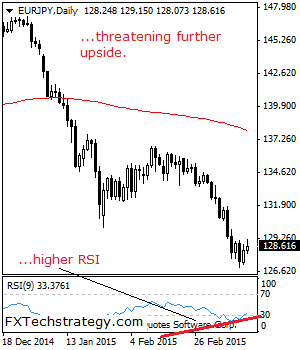

EUR/JPY Extends Corrective Recovery

EURJPY- Having triggered a correction on Monday and followed through on Tuesday, risk of more upside remains. On the downside, support comes in at the 128.00 level where a break will aim at the 127.50 level. A turn below here will target the 127.00 level with a breach turning focus to the 126.50 level. Conversely, … “EUR/JPY Extends Corrective Recovery”

Aussie Falls as RBA Minutes Mention Probability of Interest Rate Cut

The Australian dollar weakened today, though the losses were limited. The Aussie was soft following the release of monetary policy minutes that mentioned probability of an interest rate cut in the future. The Reserve Bank of Australia released the minutes of its March policy meeting today. While the RBA members decided to keep interest rates unchanged during the gathering, they also thought that “further easing over the period ahead may be appropriate.” … “Aussie Falls as RBA Minutes Mention Probability of Interest Rate Cut”

USD/CAD: Trading the Canadian Wholesale Sales

Canadian Wholesale Sales is an important indicator of consumer spending. A reading which is better than the market forecast is bullish for the Canadian dollar. Update: Canadian wholesale sales plunge 3.1% Here are all the details, and 5 possible outcomes for USD/CAD. Published on Wednesday at 12:30 GMT. Indicator Background Canadian Wholesale Sales measures the total amount of … “USD/CAD: Trading the Canadian Wholesale Sales”

No Additional Stimulus from BoJ Means Stronger Yen

The Japanese yen gained after the Bank of Japan kept its monetary policy unchanged at today’s meeting, judging that no additional monetary stimulus is required. The vast majority of the BoJ Board members voted in favor of keeping interest rates near zero and the asset purchase program at ¥80 trillion. The central bank said that the economy “has continued its moderate recovery trend.” Inflation is expected to remain close to the zero … “No Additional Stimulus from BoJ Means Stronger Yen”