Headlines from Greece accompanied us in recent weeks, but remained on the sidelines. Will they get back to center stage?

The team at Credit Agricole examines the situation using some charts:

Here is their view, courtesy of eFXnews:

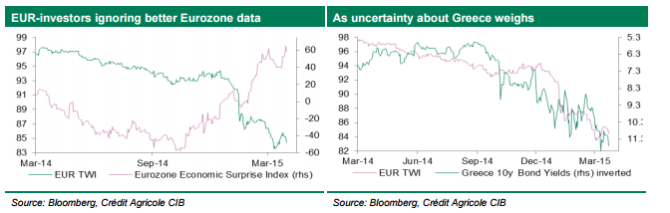

The Eurozone data calendar for next week may offer less excitement with only the German industrial production and trade data for February among the highlights. Uncertainty about Greece should therefore remain the main driver of EUR-sentiment. Investor concerns intensified again after the Greek reform proposals were met with scepticism by their creditors on 30 March.

The next IMF payment of EUR450m due on 9 April will likely keep the pressure on Athens to deliver. One cannot rule out completely the risk of a ‘Grexident’ where the troubled Eurozone member is unable to meet its immediate financial obligations. This still seems less likely to us, however.

Indeed, Greek authorities have made some important concessions as part of the latest negotiations. For example, policy initiatives like the privatization of the Piraeus Port and various tax hikes were put back on the table even though Syriza pledged to abandon such bailout commitments ahead of the January elections. More concessions should come and help Greece unlock the EUR7.5bn of bailout funds.

That said, with a deal still seemingly elusive, market uncertainty could linger and cloud the EUR-outlook next week.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.