GOLD opened this week with a gap higher, but since then it failed to capitalize on the gains. There was a sharp reaction after it tested the $1220-25 levels. It moved lower and made an attempt to close the gap. The US dollar strength played a major role in the correction. There is a major release lined up today in the US, as the FOMC Minutes will be published by the Board of Governors of the Federal Reserve, which is a guide to the future US interest rate policy. It has the potential to cause a lot of moves in GOLD and the US dollar in the short term.

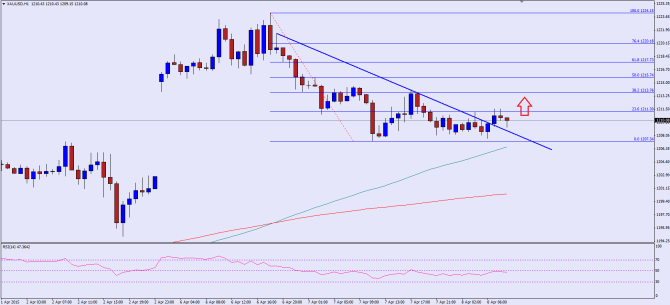

There was a critical bearish trend line formed on the hourly chart of GOLD, which was one of the reasons it was moving lower. The same trend line was breached earlier during the Asian session, which might clear the way for more upsides in the near term. One good thing to note was that downside in GOLD was stalled around the 100 hourly simple moving average. Currently, it is trading around the 23.6% fib retracement level of the last leg from the $1224 high to $1207 low. There is a major hurdle around the 38.2% fib level, as it also coincides with a swing level of $1210. Let us see whether GOLD can trade higher or not.

If GOLD moves lower, then the 100 hour MA could provide support in the short term. Any further losses might take it below $1200.

Overall, one might consider buying dips in GOLD as long as it is above the 100 hour MA.

————————————-

Posted By Simon Ji of IKOFX Technical Team: Online Forex Broker

Website: http://ikofx.com/

In this week’s podcast, we feature an Interview with FXStreet President Francesc Riverola on the industry, volatility and more

Subscribe to Market Movers on iTunes