The greenback has made a comeback of sorts, rising from the lows it suffered following the poor Non-Farm Payrolls. However, the jury is still out on whether the trend has resumed.

The team at Bank of America Merrill Lynch sees opportunities for USD bulls against the EUR, GBP and the JPY as well as the dollar index:

Here is their view, courtesy of eFXnews:

In a note to clients today, Bank of America Merrill Lynch technical strategy team updates its outlook for the USD Index, USD/JPY, EUR/USD, and GBP/USD.

Starting with the USD Index, BofA thinks that its recent correction does not yet look complete as evidence says that we should see a decline to the 95.00/94.50 zone before the larger bull trend resumes for the 106.00 area.

“USD Index bulls need a break of the Mar-31 high at 98.67 to say that the correction is over and that the bull trend has resumed,” BofA argues.

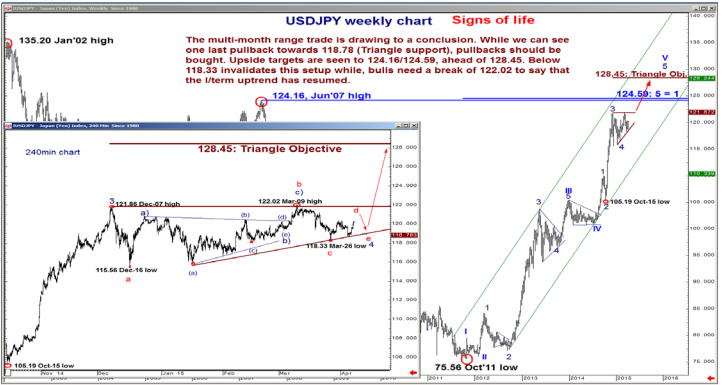

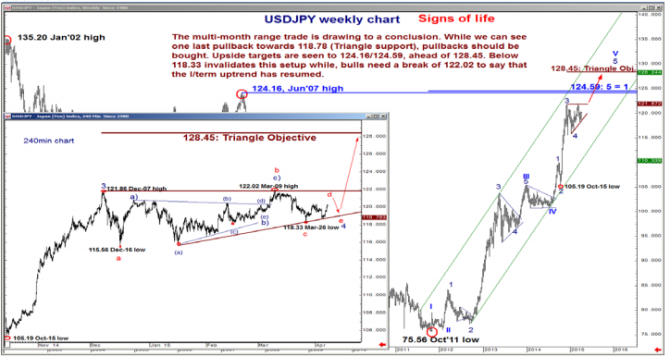

In contrast, BofA thinks that USD/JPY looks far more bullish noticing that its 4m range trade looks to be in its final throes.

“While allowing for one last pullback toward 118.78 (4m Triangle support), pullbacks should be bought. Upside targets are seen to 124.16/124.59, ahead of 128.45. Below 118.33 (Mar-26 low) invalidates the bullish setup,” BofA projects.

Moving to EUR/USD, BofA holds the view that EUR/USD correction could still extend gains to 1.1267/1.1389 before renewed topping and a resumption of its l/term downtrend towards 1.0283/1.000.

Same for GBP/USD, where BofA thinks it can extend to 1.5169/1.5325 before resuming its long term downtrend to 1.4035/1.3504.

“USD bulls need a EUR/USD break below 1.0713 (Mar-31 low) and GBP/USD break below 1.4750 (Apr-01 low) to say that the USD bull trend has resumed,” BofA argues.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.