The greenback made a comeback of sorts. Is this just a correction or has the long term dollar trend have room to improve?

The team at BNP Paribas sees more to come and explains:

Here is their view, courtesy of eFXnews:

“…Some market participants are revisiting their bullish USD views, arguing that the rally is nearing an end. We are sympathetic to the idea of a more two-way market and a slowing in the pace of USD gains, but we believe we are still a long way from the end of the bullish USD trend.

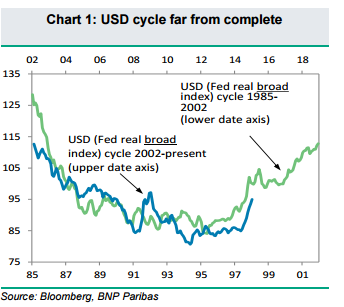

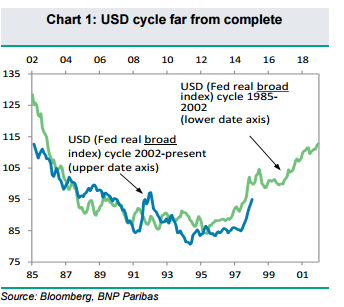

USD long-term bullish cycle is far from complete. Although the pace of USD appreciation has been rapid, historical comparisons do not support the idea that the dollar is at levels that would mark an end of a cycle. At the end of March the Fed’s ‘broad’ and ‘major currencies’ inflation-adjusted USD indices were, respectively, 16% and 11.5% below their 1995-2002 bull cycle peaks. Given the consistency in the length of the dollar’s bull and bear cycles, the current upward trend appears to have another three to four years to run. Our fair-value models are signalling that dollar valuations are now more expensive, but are not yet a major constraint.

…The bottom line is that we see forecasts for the end to the USD rally as premature at this stage. The next significant catalyst for the USD rally should be the Fed rate lift-off, which is still nearly six months away, in our view. ”

Vassili Serebriakov – BNP Paribas

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.