The Draghi show was stolen by a protester that interrupted the press conference. And what about the euro? Has its path been altered?

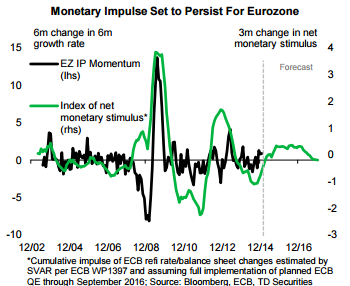

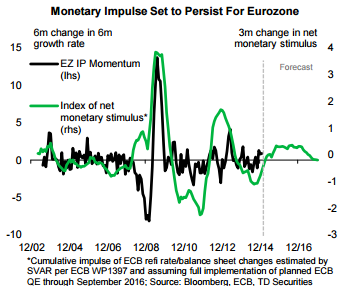

The team at TD weighs in, and sees a downwards trajectory. Here’s why, with a chart:

Here is their view, courtesy of eFXnews:

At today’s ECB press conference, President Draghi continued to distance himself from verbally jawboning the EUR, continued to rule out another rate cut, continued to say the ECB is rule-based when asked how long they can support Greece, said he saw no signs of a bond bubble, and continued to avoid saying anything to suggest tapering is a concept they have even thought about at this stage, notes TD.

“So overall, the ECB continues to be optimistic on the impact of its measures and likes the improvement it is seeing in the data and lending surveys, but not enough to significantly shift their overall message. There was no mention of a review to broaden the assets eligible for SSA purchases, but this may still follow in the non-policy meeting later this month,” TD adds.

“Overall, this provided minor support to both fixed income (no bubble means buy bonds) and EURUSD (uncertain passthrough of weaker currency to inflation means maybe weaker EURUSD doesn’t help), TD argues.

“Nothing here changes our view that bunds should continue to trade in a range capped at around 30bps for the next 3-6 months and EURUSD should trade below parity by 2015Q3,” TD projects.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.