EUR/USD did not fall off the cliff of 1.05 nor did it climb above the 1.1050 mountain. What’s next for the pair, and where is the greenback headed in general?

The team at Goldman Sachs weighs in:

Here is their view, courtesy of eFXnews:

The USD in general seems to have struggled as of late as the USD Index (DXY) didn’t make it too far past 100, notes Goldman Sachs.

“The high from March was 100.39. The market has failed to break ~100 the past two consecutive months. It’s clear this is an important pivot to focus on,” GS adds.

“It is worth noting that the long-term triangle target at 102.50 has not yet been satisfied. So while a correction is clearly underway, there is still reason to believe that the USD uptrend is largely intact,” GS argues.

Reflecting that in EUR/USD, GS thinks that although the pair has squeezed a little further than initially expected, there is still a case to be made for downside.

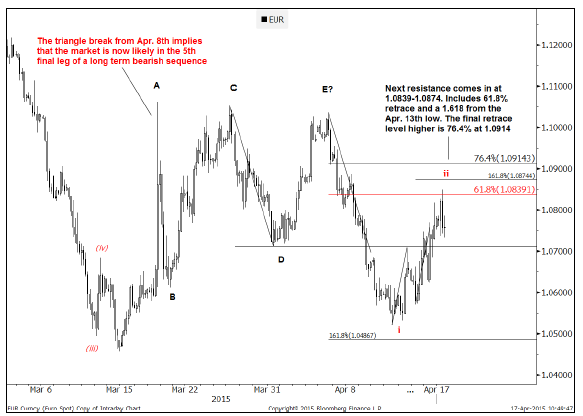

“The wave count can still be interpreted as being negative. The fact that the market has recently broken from an ABCDE triangle suggests that it is likely starting the final leg of a bearish sequence (ABCDEs tend to be 4th waves),” GS clarifies.

“The next resistance to watch is 1.0839-1.0874. This includes 61.8% retrace and a 1.618 from the Apr. 13th low. The final retracement level above there is 76.4% at 1.0914. While its possible for wave ii to retrace the entire length of wave i back to 1.1036 (high from Apr. 6th), ideally want to remain below 1.0914 to maintain conviction/ momentum,” GS argues.

Bigger picture, GS holds the view that the ultimate medium-term targets are still around 1.0286-1.0103.

“This 1.0286-1.0103 pivot includes 76.4% retrace of the entire ‘00/’08 rise as well as an equality target taken from the Jul. ’08 peak. Reaching it would satisfy a multi-year ABC which began in ‘08. It would consequently be an ideal place to take on a more neutral outlook,” GS clarifies.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.