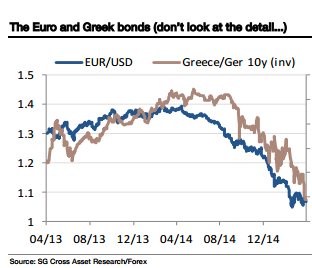

The euro seems to be paying more attention to teh troubles in Greece and less to US indicators and euro-zone ones.

All in all, EUR/USD is trading within a wide range for quite some time. These moves are quite interesting, but a more interesting move would be a break down out of the range towards parity. This scenario could make the break, according to Kit Juckes of SocGen:

Here is their view, courtesy of eFXnews:

“The Greek crisis was ignored by the FX market last week as peripheral spreads widened and the Euro rallied. This morning, it is cited as the reason for the Euro to be softer and the dollar to be rallying again.

The reasons given for day-to-day gyrations of EUR/USD within its broad 1.0450-1.1050 range need to be taken with a pinch of salt!

However, a Greek default without ‘Grexit’, might be the single most negative outcome for the Euro, and ECB Vice-President Vitor Constancio, pointedly observed that default doesn’t automatically imply exit. Meanwhile, as the government scrambles around for cash, there is much talk of Greece introducing a parallel currency.”

Kit Juckes – SocGen

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.