May 7th is getting closer and polls show a head to head battle between the rival parties. The pound is relatively resilient so far, but this may not last too long.

The team at ING shares its view about a potential knee-jerk reaction.

Here is their view, courtesy of eFXnews:

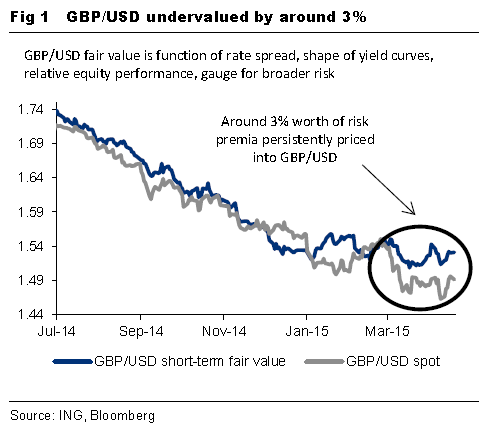

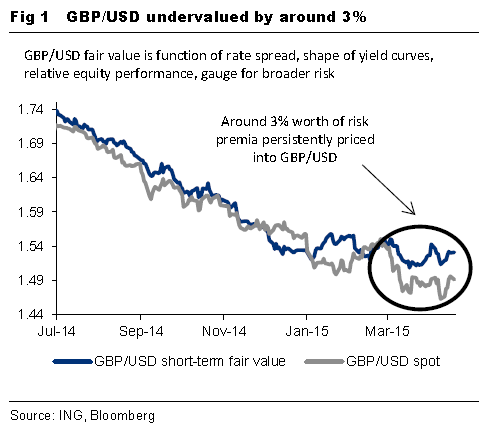

As GBP started feeling the heat of the upcoming election uncertainty, ING estimates, around 3% worth of risk premia has been consistently reflected in GBP/USD over the past 3 weeks.

“With risk premia heavily reflected in GBP crosses and GBP implied volatilities elevated,being short GBP ahead of the election either via spot or option market is no longer the most attractive trade. Rather, we see opportunities in the post-election world, particularly if we see a knee-jerk reaction in GBP higher (once the market discounts the uncertainty about the election results and potentially overreacts),” ING argues.

“We don’t think a material reduction in GBP risk premia will be warranted and rather expect the risk premia to remain persistently priced into GBP. Hence, GBP rallies should be faded. Our preferred way is short GBP/USD, given our view that USD softness will be temporary and USD starts gaining ground in summer once better US data bring back expectations of Fed rate hikes. We target the GBP/USD 1.44 level,” ING advises.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.