EUR/USD has been weakening due to weaker euro-zone data, and that is a change after many positive surprises.

And now, the pair may have more room to fall with the greenback taking the driver’s seat. Here is the view from Nordea:

Here is their view, courtesy of eFXnews:

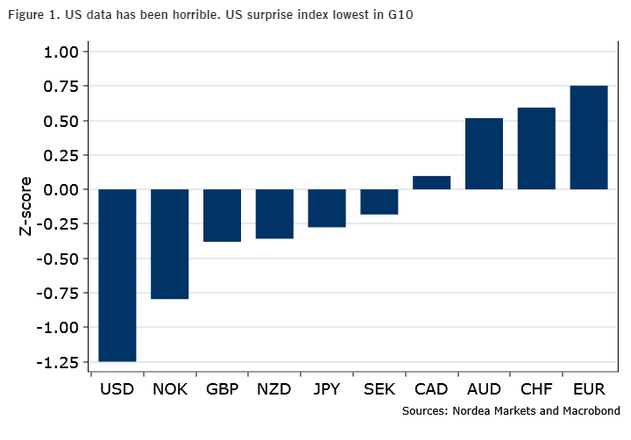

The USD has fared well despite the recent batch of horrible data. While this may be construed as the market not reassessing the Fed outlook we think the USD’s appreciation trend would have continued had US data continued to be solid. We think it is starting to make sense for the market to reassess its outlook for the US economy and the Fed, this time in a more positive direction.

-The Fed and the market is overly worried about US growth.

-The USD outlook is becoming more positive.

-Greece negotiations likely to cause volatility.

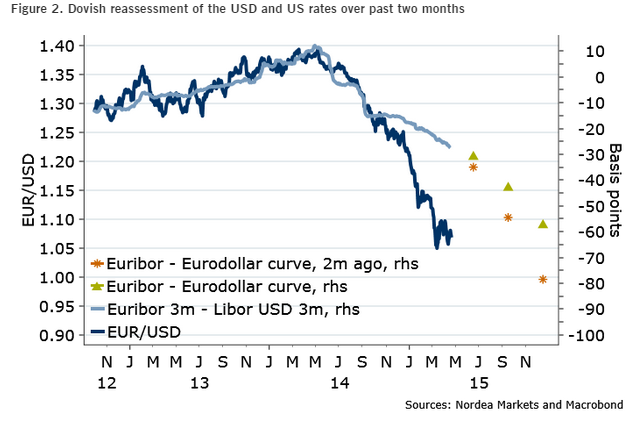

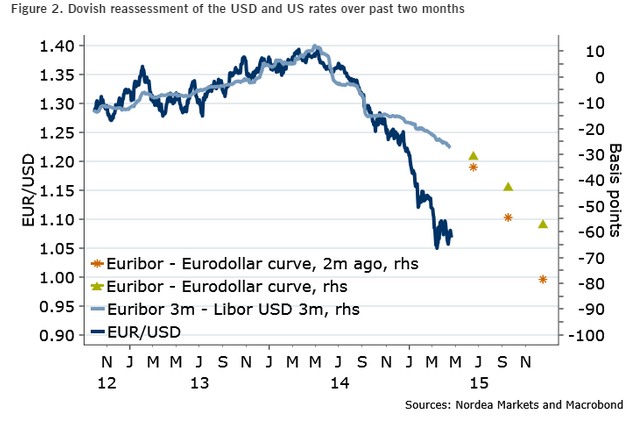

We argued earlierthis year that the near-term outlook for the USD was becoming cloudy, as e.g. US data & inflation was likely to disappoint. On the other side of the Atlantic, Euro Area growth was going to improve, while the launch of ECB QE would, counter-intuitively, remove one factor weighing on the EUR. Since March, the dollar index DXY has been stuck in a five point range, while EUR/USD has treaded water apart. In short, despite converging growth expectations, which would normally be EUR-positive, EUR/USD has been fairly steady.

Recent US data have put a dent in the economic divergence theme, but as we argued in February, this doesn’t necessarily impact much on the policy divergence theme. Yes, the Federal Reserve has lowered its estimates of the end-2015 and 2016 policy rates (USD-negative), but this has coincided fairly nicely with ECB hiking its inflation trajectories (EUR-negative given an unchanged policy rate outlook).

As for the Fed, its goal-posts, at least from the market’s point of view, has been changing recently. During the autumn, wage growth was all the rage, with wages needed to accelerate before the first rate hike was pondered. Then in February this year, focus shifted to inflation, with inflation needed to stabilize and rise before the Fed aimed at lift-off. Most recently, focus has been shifting to growth, with data setbacks putting fear into certain Fed officials.

NY Fed’s Dudley has however argued that Q1 weakness will prove to be largely temporary, a sentiment which we agree. After all, to quote Dudley; “January and February weather was 20 to 25 percent more severe than the five-year average”. Bottlenecks at some ports also disrupted sales and productions earlier this year. Container traffic is now surging after these shutdowns.

The USD has fared well despite horrid US data in over the past few months. How will it fare when US activity recovers? While it could be argued that the lack of large USD-negative reaction to recent US data may be construed as the market not reassessing the USD outlook in a more negative direction. It might just as well be that the USD’s appreciation trend would have continued had data continued to be solid.

We think it makes sense for the market to reassess its outlook for the US economy, this time in a more positive direction. This will translate to more hawkish re-pricing of the USD. It should also be remember that core inflation has surprised positively three months in a row. We think that the US inflation cycle has turned (up)…

Furthermore, the risks surrounding Greece are EUR-negative, at least leaving very short term positioning-driven movements aside. Greek banks are relying on ECB liquidity (ELA) to avoid financial collapse. The next important deadline for Greece is a payment to IMF on May 12. A failure to pay could trigger the ECB to cut off Greece’s access to ELA funding. The IMF could however also opt to accept a delay in payments, which would buy Greece time until mid-July. No matter the final outcomes, negotiations between Greece and its creditors seem likely to cause volatility in the weeks to come.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.