The Canadian dollar enjoyed a nice ride on strengthening oil prices. Is it too little? Too much?

The team at Credit Agricole examines.

Here is their view, courtesy of eFXnews:

The focus for CAD next week shifts to growth numbers for February. The market is looking for a slight moderation in the annualised figure to 1.8% from 2.4% previously.

The market expects monthly growth to slip -0.2% from the -0.1% clip previously. The weakness reflects the second-round effects of the oil price shocks on growth and investment. Recall, however, the BoC expects a sharp payback in subsequent quarters as the oil impact fades. We still disagree with the BoC’s growth assumptions for 2015, thinking the data will force it to revise its growth outlook lower later in the year.

In turn, scope remains for the BoC to cut rates in H215, though the odds have diminished given the BoC’s hawkish shift.

Our trading strategy for CAD in the near term reflects the recent recovery in oil prices and the prospects for the CAD short squeeze to persist.

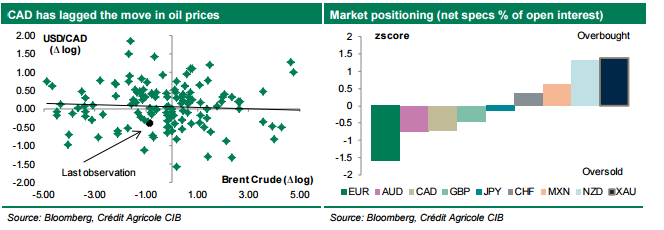

Indeed, CAD continues to lag the move in oil prices, which suggests USD/CAD should hit 1.20 very soon. Furthermore, market positioning and technical indicators suggest CAD is oversold, increasing the prospects for a short-term rebound.

For now, we like long CAD/JPY with the upcoming BoJ meeting a potential catalyst for a weaker JPY. However, in the medium term, we think USD/CAD will test the recent highs near 1.28 as poor growth prospects force a BoC rethink.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.