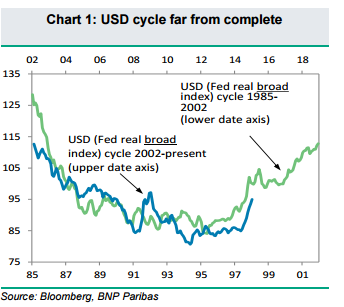

The greenback made a comeback of sorts. Is this just a correction or has the long term dollar trend have room to improve? The team at BNP Paribas sees more to come and explains: Here is their view, courtesy of eFXnews: “…Some market participants are revisiting their bullish USD views, arguing that the rally is nearing an … “USD: They Think It’s All Over…Far From It – BNPP”

Month: April 2015

GBP/USD: Trading the British CPI Apr 2015

British CPI, released each month, is the primary gauge of consumer inflation. A reading which is higher than the market forecast is bullish for the pound. Update: UK inflation remains at 0% – GBP/USD slides Here are all the details, and 5 possible outcomes for GBP/USD. Published on Tuesday at 9:30 GMT. Indicator Background Analysts consider CPI one … “GBP/USD: Trading the British CPI Apr 2015”

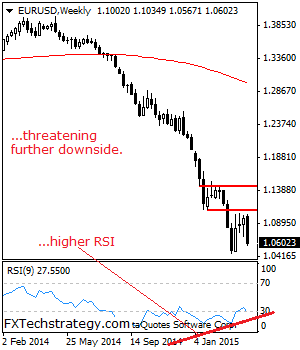

EURUSD: Looks To Resume Broader Downtrend

EURUSD: With EUR selling off strongly the past week, it looks to resume its broader medium term downtrend. On the downside, support lies at the 1.0500 level where a violation will aim at the 1.0461 level. A break of here will aim at the 1.0400 level with a turn below that level targeting the 1.0350 … “EURUSD: Looks To Resume Broader Downtrend”

GBP/USD: More drops ahead; USD/CAD: Consolidation – SocGen

Currencies have moved quite a bit after the Easter holiday. GBP/USD reached new lows and USD/CAD fluctuated quite a lot. The team at SocGen analyzes the technical charts and provides interesting analysis: Here is their view, courtesy of eFXnews: GBP/USD violated the multi-year upward channel last month, confirming the possibility of an extension in the downtrend, … “GBP/USD: More drops ahead; USD/CAD: Consolidation – SocGen”

Dollar Regains Strength During Trading Week

Lately, the US was experiencing problems with keeping its upward momentum, but the greenback regained its strength during this week during which it was one of strongest currencies on the Forex market. The major reason for the strength was the minutes of the latest Federal Reserve’s policy minutes. The dollar has started the week a bit weak but quickly recovered and continued to move up. The currency received a significant boost the Fed minutes … “Dollar Regains Strength During Trading Week”

Economic Reports from Canada Help Loonie

The Canadian dollar managed to erase losses against its US counterpart by the end of the Friday’s trading session with the help of positive domestic data. The currency even gained against the euro, reaching the highest rate since May 2013. The loonie also reduced losses versus the Japanese yen but was unable to erase them completely. Canadian employers added 28,700 jobs in March, a rather big figure for Canada, while analysts thought … “Economic Reports from Canada Help Loonie”

GBP/USD Hits Lowest Since June 2010

The Great Britain pound fell today, touching the lowest level since June 2010 against the US dollar, as underwhelming economic data from the United Kingdom added to the downside pressure on the currency. The Friday’s economic data was unfavorable to the currency for the most part. Construction output fell 0.9 percent in February even though economists predicted an increase, and while industrial production increased, the growth was just 0.1 percent versus the forecast 0.3 … “GBP/USD Hits Lowest Since June 2010”

Data from Australia & China Unfavorable to Aussie

The Australian dollar went down today as economic data from both Australia and its biggest trading partner, China, was unfavorable to the currency. While the Aussie managed to gain on the euro, it declined versus the US dollar and the Japanese yen. Australian home loans increased 1.2 percent in February from the previous month. While not a bad reading but itself, it was more than two times below the forecast value … “Data from Australia & China Unfavorable to Aussie”

Yuan Falls as Producer Prices Remain in Deflation

The Chinese yuan slipped against the US dollar today even though China’s consumer price inflation remained steady at an elevated level. The problem for the currency is the fact that producer prices remained in deflation for the 38th consecutive month. The National Bureau of Statistics of China reported that the Consumer Price Index grew at the steady rate of 1.4 percent in March from a year ago, at the same pace as in February, while analysts anticipated small slowdown. … “Yuan Falls as Producer Prices Remain in Deflation”

Japanese Yen Retains Gains as BOJ Keeps Asset Program Steady

Japanese yen is retaining many of the gains it made earlier this week following a Bank of Japan announcement that indicates the asset buying program is likely to remain steady, rather than expand. With quantitative in place for European currencies, Japan has the upper hand for now. Japanese yen continues to gain today, thanks in large part to an announcement from the Bank of Japan earlier this week. Many Forex traders … “Japanese Yen Retains Gains as BOJ Keeps Asset Program Steady”