The US Dollar index is climbing again, heading toward the 100 level again. With the Federal Reserve expected to hike interest rates later this year, and with the greenback remaining the dominant currency in the world, there’s little to slow it down. Yesterday, the US dollar index hit an 11-year high. Last month, the dollar index did touch above 100, but it fell back quickly. Other than that … “Dollar Index Continues Climb Toward 100”

Month: April 2015

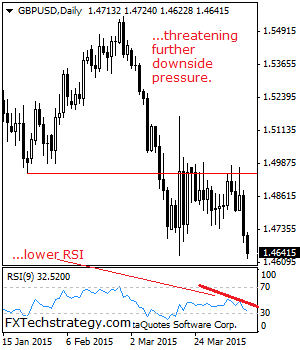

GBPUSD: Weakens, Eyes Key Support And Possibly Lower

GBPUSD: With continued downside seen on Friday and the pair testing its key support at the 1.4633 level, further price extension is expected. Support lies at the 1.4600 level where a break if seen will aim at the 1.4550 level. A break of this level will turn focus to the 1.4500 level. Further down, support … “GBPUSD: Weakens, Eyes Key Support And Possibly Lower”

MahiFX appoints Alexander Ridgers as Head of Analytics –

New Zealand based broker MahiFX has appointed Alexander Ridgers, a former Oanda Trader to the newly created role of head of Analytics. The firm has successfully weathered the “SNBomb” in January and continues its expansion. For more about the new role and the new appointment, here is the official press release: London, 8 April 2015 – As … “MahiFX appoints Alexander Ridgers as Head of Analytics –”

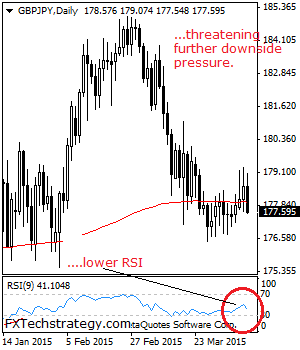

GBPJPY: Vulnerable, Risk Points Lower

GBPJPY: Having GBPJPY turned lower after losing its intra day strength, a move further lower is now envisaged in the days ahead. On the downside, support comes in at the 177.00 level where a violation will aim at the 176.00 level. A break below here will target the 175.00 level followed by the 174.00 level. … “GBPJPY: Vulnerable, Risk Points Lower”

Great Britain Pound Retains Weakness vs. Dollar & Yen

The Great Britain pound sank yesterday after the Bank of England made no changes to its monetary policy and UK economic data came out mixed. While the sterling erased its losses versus the euro today, the currency retained its weakness versus the US dollar and the Japanese yen. The BoE left its main interest rate and the size of asset purchases unchanged at yesterday’s policy meeting, in line with market expectations. As it … “Great Britain Pound Retains Weakness vs. Dollar & Yen”

Greece Remains Hurdle to Euro

Greece and its debt problems continue to have an adverse effect on the euro even after the indebted country fulfilled its obligation to repay the loan to the International Monetary Fund on Thursday. The shared 19-nation currency fell in spite of the news. Greece made a repayment of â¬450 million loan to the IMF yesterday. Still, IMF chief Christine Lagarde did not provide in her interview with CNBC a definite answer to the question if Greece will be … “Greece Remains Hurdle to Euro”

NZ Dollar Follows Aussie in Rally

Like its Australian counterpart, the New Zealand dollar rallied during the current trading session. There were no domestic fundamentals to support the New Zealand currency, but the general market sentiment was enough to lift it higher. Yesterday, traders focused on the hawkish parts of the Federal Reserve minutes, pushing currencies down against the US dollar. It looks like today the market concentrated on the dovish parts of the report, allowing the kiwi … “NZ Dollar Follows Aussie in Rally”

Oil Helps Canadian Dollar in Forex Trading

Canadian dollar is a little bit higher today, thanks in part to oil prices. Crude oil is on the rise again, and yesterday’s announcement of the merger between Shell and BG Group is having its effect as well. Oil prices are back above $50 a barrel today, and that is helping the loonie in Forex trading. Canadian dollar is getting a boost from higher oil prices, although prices are nowhere … “Oil Helps Canadian Dollar in Forex Trading”

Australian Dollar Gets Boost from Fundamentals

The Australian dollar rallied today, getting a boost from favorable domestic macroeconomic data as well as from speculations that the Federal Reserve will postpone monetary tightening. The seasonally adjusted Australian Industry Group/Housing Industry Association Australian Performance of Construction Index rose by 6.2 to 50.1 in March. This means that the Australian construction sector returned to growth, albeit a slow one. Meanwhile, traders continue to speculate about possible timing of an interest … “Australian Dollar Gets Boost from Fundamentals”

UK Pound Pulls Back After Yesterday’s M&A Fueled Surge

UK pound is pulling back today after its surging performance yesterday. News of a major energy merger helped the sterling yesterday, and today the currency is consolidating a bit as Forex traders consider the situation and focus on Fed minutes. Yesterday, M&A interest surged as Royal Dutch Shell announced that it would merge with BG Group. The merger created a great deal of interest in the UK pound, and sterling surged against its … “UK Pound Pulls Back After Yesterday’s M&A Fueled Surge”