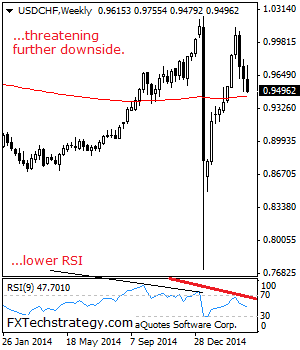

USDCHF: With a third week of decline occurring the past week , further weakness is envisaged. On the downside, support comes in at the 0.9400 level. A turn below here will open the door for more weakness towards the 0.9350 level. A cut through that level will open the door for further decline towards the … “USDCHF: Downside Pressure Remains Intact”

Month: April 2015

GBP/USD: Trading the British Services PMI Apr. 2015

The British Services PMI (Purchasing Managers’ Index) is based on a survey of purchasing managers in the services sector. A reading which is higher than the market forecast is bullish for the pound. Update: UK services PMI jumps to 58.9 points Here are all the details, and 5 possible outcomes for GBP/USD. Published on Tuesday at 9:30 GMT. Indicator Background Market … “GBP/USD: Trading the British Services PMI Apr. 2015”

Interview with FXStreet President Francesc Riverola on the industry,

This week we feature an interview with Francesc Riverola, the founder and president of FXStreet – one of the largest forex portals. We discuss trends in the forex industry, Francesc’s observation about the SNBomb, the future of forex as an asset class and lots more. You are welcome to listen, subscribe and provide feedback. After a … “Interview with FXStreet President Francesc Riverola on the industry,”

EUR: Should We Still Worry About Greece? – Credit

Headlines from Greece accompanied us in recent weeks, but remained on the sidelines. Will they get back to center stage? The team at Credit Agricole examines the situation using some charts: Here is their view, courtesy of eFXnews: The Eurozone data calendar for next week may offer less excitement with only the German industrial production and … “EUR: Should We Still Worry About Greece? – Credit”

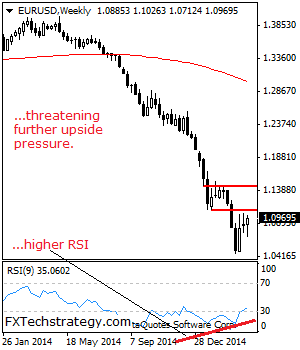

EURUSD: Looks To Build On Strength

EURUSD: With EUR closing higher to reverse most of its past week gains, further strength is envisaged in the new week. Resistance is seen at 1.1050 level with a cut through here opening the door for more downside towards the 1.1000 level. Further up, resistance lies at the 1.1100 level where a break will expose … “EURUSD: Looks To Build On Strength”

Trading Week Ends on Sour Note for Dollar

Dollar bulls had high expectations for this trading week due to the optimistic outlook for the US non-farm payrolls. But their hopes were shattered after the employment report turned out to be far worse than it was expected. Market participants have been mostly bullish on the dollar as they were anticipating another solid reading from NFP. Yet in a surprising turn of events the data came out much weaker … “Trading Week Ends on Sour Note for Dollar”

Weak Non-Farm Payrolls Hurt US Dollar

The US dollar received a significant hit to its strength today after the release of non-farm payrolls. While dollar bulls were very optimistic ahead of the NFP report, their optimism evaporated after the actual reading turned out to be almost two times weaker than forecasts. US employers added just 126,000 jobs in March while market participants were counting on growth by at least 246,000. Moreover, the previous months increase … “Weak Non-Farm Payrolls Hurt US Dollar”

Economic weakness reaches jobs, but what will you buy

The gain of only 126K jobs in March is a bitter disappointment. Coupled with downwards revisions of 69K makes it worse. We are finally seeing the labor market catching up with the dismal economy. Is this enough for a change of course for the US dollar? Or just an extension of the correction? Or in … “Economic weakness reaches jobs, but what will you buy”

Euro Benefits From Low Volume, Profit Taking

Euro is getting a little help today, thanks to low volume on the Forex market, and a bit of profit taking at the end of a week that saw a precipitous drop to the 19-nation currency. Right now, there is a low volume in trading today, with the Easter holiday coming up. Additionally, euro is getting some help from the fact that there are indications that US jobs data isn’t going to be as positive … “Euro Benefits From Low Volume, Profit Taking”

USDCAD: Weakens, Vulnerable To The Downside

USDCAD: The pair remains weak and vulnerable to the downside more weakness envisaged. On the upside, resistance is seen at the 1.2600 level followed by the 1.2650 level. Further out, resistance comes in at the 1.2700 level where a turn lower may occur. But if further recovery is triggered resistance comes in at the 1.2750 … “USDCAD: Weakens, Vulnerable To The Downside”